Nfts

What the NFT Phenomenon Tells Us About the Monetary and Creative Value of Art ‹ Literary Hub

Among the abandoned SoHo storefronts in Manhattan, a gallery lit by candles and computer screens illuminated the cobblestone streets, where a lineup of newly minted millionaires anxiously waded through the winter winds to see what their crypto fortunes could buy. The doors opened on December 9, 2021, to a cavernous space in which dozens of guests sipped champagne and devoured morsels of designer sushi as jazz musicians played. There were venture capitalists and supermodels; basketball stars and their sycophants; film scions and political lobbyists; technophobes and technocrats; technobabes and technorats.

That evening inside Bright Moments Gallery epitomized the new gods and their rituals. They spoke in strange and unfamiliar tongues. Hieroglyphs on the bathroom walls included new terms like “metaverse” and “Ethereum.” Above the toilet was philosophy: “NFTs are the bridge from conceptual art to contractual art.” The messages continued deeper into the gallery, where someone had wallpapered the elevator with hacker mantras like “You can’t spell culture without cult” and “Fear kills growth.”

Tokenization had already exposed the fragility of the traditional system that defined artistic value.

Beyond that elevator was a dark cement basement where Tyler Hobbs stood, flanked by two gallery associates: one holding an iPad and the other looking for security threats in the shadows. Clients would join the artist and enter their online wallet information into the tablet, securing the NFTs that Hobbs had coded into existence over the preceding weeks. This precious art cargo had, with the tap of a screen, turned Hobbs into one of the wealthiest artists you’ve never heard of.

The absurd scene inside Bright Moments Gallery made Hobbs look like a fake. He was a lanky thirty-four-year-old former software engineer from Texas, sitting in an empty cellar below a gallery full of partying supplicants and blank walls. And despite a lack of inventory, attendees upstairs had paid $7 million altogether for ninety-nine original artworks. Rembrandt he was not; Hobbs used code instead of a paintbrush. But he never cared about re-creating the past glories of art history; the romantic vision of a starving artist never held much appeal. Before cryptomania, Hobbs rarely earned money from his artworks. It was nothing more than a passion project. “Digital art was usually a sentence of poverty,” he later explained to me. Nowadays, it’s his bank account.

The first windfall came seven months earlier, when Hobbs started turning his creations into NFTs. He understood that tokens were traded on the blockchain, a decentralized ledger system recording ownership information to prevent thefts and forgeries. The blockchain could also classify NFTs as unique assets, deriving their price based on rarity and demand. Hobbs learned these dynamics the easy way in June 2021, selling 999 NFTs almost immediately after offering them online and earning nearly $400,000 worth of Ethereum cryptocurrency in the process. He claimed that secondary sales, which typically come with artist royalty fees of between 5 and 10 percent in the NFT world, had brought an additional $9 million into his pocket.

Hobbs was just one of dozens—if not hundreds—of amateur artists who suddenly found themselves swimming in crypto cash and struggling to understand their own success as more than a combination of hard-earned recognition and dumb luck. He wanted to believe that society’s equation for determining cultural value and the price of art had changed during the pandemic, as people became more accustomed to living online. He wanted to believe that his sudden windfall was a reward for the years he had spent struggling as a starving artist. In other words, he wanted to believe in the fundamental lie that we all believe: merit equals money.

NFTs united the most conspiratorial corners of the internet: the power brokers and the power hungry, who believed that technology could change the world, one pixel at a time. In their rearview mirror: two financial crises and a raging pandemic that had already killed more than six million people worldwide. Up ahead: the capitalist fantasia of a multibillion-dollar industry summoned by artists and algorithms.

Hobbs found himself working in the zeitgeist of economic and technological forces. The same financial institutions and wealthy investors who had capitalized on the pandemic recession and the 2008 financial crisis were looking at NFTs as a technology that could perpetuate the rampant volatility and speculation that had contributed to their record profits. Selling securities as art was a guise for laundering those dynamics often found in the unregulated art market. These forces succeeded by asking questions that none of us, including government watchdogs, could answer: What is the value of art? And how do you put a price on something that is traditionally seen as priceless?

*

If tulipmania provided an outlet for the social anxieties that succeeded a devastating plague, then the NFT boom fulfilled a similar function during the Covid-19 pandemic. Lockdowns produced a strange alchemy in which virtual life became reality, and a speculative financial boom entangled the economic, political, social, and medical emergencies of the time. The framework that structured civilization nearly collapsed, and we lived between the creaking gears of recovery.

Most people were happy to see the old guard in place during this era of uncertainty. President Joseph R. Biden Jr., was the oldest person to ever win the White House, and Congress was controlled by two politicians who were older than him: House Speaker Nancy Pelosi and Senate minority leader Mitch McConnell. The top-grossing film in movie theaters starred a sixty-year-old intellectual property named Spider-Man, and the most successful song on the radio had first been released by the singer Kate Bush in the 1980s. Even the economic challenges were old, combining the stagflation crisis of the 1970s with the poor debt-to-GDP ratios of the 1940s alongside the overvalued tech companies of 2000 and the sovereign debt problems of 2009.

Life might have continued spinning around the circumference of these historical reference points if uncertainty was not such an effective crucible for change; if the young did not inevitably rise to challenge the old.

So many questions were left unanswered within their vortex of dada that I experienced inside Bright Moments Gallery and elsewhere throughout my journey of writing this book. The prattling of otherwise intelligent businessmen undermined an extensive reporting effort to outline the NFT industry seriously at the critical moment of its ascension. It made no sense. Grown men were infantilizing themselves in the public eye, claiming that cartoon images of pothead monkeys and pixelated alien dudes would spark a new economic age of digital ownership. The claims were so immediately ridiculous that many government regulators dismissed the industry as a short-lived fad that would perish the way Beanie Babies had. And yet! Their increasingly deranged pitch had attracted nearly $30 billion in venture capital within a period of two years. Younger generations also embraced NFTs as a symbol of their own rising power in society and a definitive breaking point with older models of cultural production.

The contradictions were obvious, so my journey of discovery began with a few simple questions: Why were investors willing to debase themselves for digital collectibles? How did the economic conditions of the pandemic fuel a speculative market cycle? Who benefited from a digital culture war? And what role would artists play in determining the future of the internet?

As a reporter with The New York Times, I had already chronicled the market’s development and realized that an even greater story was hidden beneath the headlines. But I also knew that finding the truth would require an extensive investigation unlike anything that would fit neatly into the newspaper’s column inches. So from hundreds of interviews with artists, gallerists, investors, entrepreneurs, academics, fanatics, skeptics, regulators, watchdogs, and even a priest emerged this portrait of the virtual world triumphing over the physical realm.

Then everything crashed. During the succeeding summer months, when I wrote the majority of this book’s twelve chapters, the cryptoeconomy shredded through nearly $2 trillion, and the once-booming market for nonfungible tokens deflated by nearly 97 percent of its record volume. Suddenly there were NFT collectors being charged with insider trading, international manhunts for crypto developers, and thousands of digital heists. I felt like I was back to where my career had begun: tracking down money launderers and fraudsters in the art market.

My purpose recalibrated with the changing fortunes of my subjects, and a growing consensus that the tech sector was headed toward another recession. A vision of a more ambitious story emerged, one that would tell uncomfortable truths about how the wealthy enlisted the starving artists as bannermen in their battle to re-create the pre-2008 financial system, building an army of crypto Rembrandts battling for relevance and survival. Over the last forty years, the contemporary art market has served as an economic laboratory for the rich to develop a shadow banking system of alternative assets and hedged liquidity. NFTs were a by-product of those experiments, providing financial tools branded as digital art that could be monetized at lightspeed. The implication of this exchange has been wide-reaching. Even after the secondary market for NFTs imploded, the underlying technology has become a normalized part of the art world and the financial system; it has also helped innovate other industries, like gaming, music, advertising, health care, and logistics.

The results of what became a three-year investigation are now yours to read. One might consider it only a slim volume in a much longer history of cultural economics, but the story is nonetheless an enthralling case study for those curious to understand the dynamics of speculation, and how the forces of art, technology, and money once conspired to change the world.

Throughout the book, I have carefully reconstructed scenes and incorporated dialogue drawn from my own interviews and

those sourced from publications, financial statements, internal documents, private recordings, investor slideshows, blockchain data, photographs, and videos. Every detail and conversation appearing in these pages has been subjected to fact-checking, and throughout my reporting I have followed the strict rules of journalism that I learned at The New York Times to ensure my

impartiality and credibility. I have never directly participated in the cryptoeconomy and have no financial interest in the artists mentioned here. The revelations within these pages were also shared with the appropriate people, giving them enough time and information to comment on my findings. Finally, I owe an immense debt of gratitude to the many sources who spent hours and hours speaking with me. These conversations were frequent, spread across several years, and often came during challenging life events. It’s a great privilege to have gained their trust, and an immense honor that they have entrusted me to tell this story.

The requisite struggle to bind art and money together into a single concept—the NFT—provoked the most primal feelings of greed, vanity, doubt, and revenge.

What follows is a largely chronological account of the NFT market’s rise, fall, and reboot. There will be important side quests along the way: a discussion of NFT artworks in light of the historical reception of photography; a look at how World of Warcraft determined the mechanics of the cryptoeconomy; a war between the billionaire Kenneth Griffin and the crypto investors attempting to buy a copy of the United States Constitution; the time a Miami businessman set fire to a priceless Frida Kahlo drawing that he wanted to sell as a digital collectible; the role NFTs played in the fraud perpetrated by Sam Bankman-Fried and his company, FTX; and how cryptocurrencies normalized incredibly risky bets in the financial sector during the March 2023 banking crisis.

The story includes a baroque cast of characters whose entrances and exits sometimes feel like they are pulled from a nineteenth-century Russian novel. I have done my best to stage-manage their appearances without straying from the truth. But a certain amount of whiplash should be expected; these are eccentric people skilled at using misinformation and needlessly confusing jargon to convince the public of their superiority. Many use pseudonyms to evade scrutiny—yes, there’s a Vincent Van Dough and a Cozomo de’ Medici. Artists have remained at the center of this story despite the noise, and there are four major artists who can tell the tale of NFTs better than anyone else: Tyler Hobbs, Mike Winkelmann, Justin Aversano, and Erick Calderon.

Each man represented a different kind of starving artist who entered the NFT bubble imagining that his career would be one thing and exited the crash realizing that it had become something entirely different. Their desires were simple at the beginning. One hungered for recognition; another craved wealth. But tokenization had already exposed the fragility of the traditional system that defined artistic value, leaving artists to strike hard bargains with greater economic forces in the technology and finance industries. The requisite struggle to bind art and money together into a single concept—the NFT—provoked the most primal feelings of greed, vanity, doubt, and revenge.

*

Those feelings were palpable inside Bright Moments Gallery as Hobbs took the stage. With every push of a button, he generated another artwork from his algorithm. The jazz band stopped playing, and the crypto hordes quietly sipped their champagne as he grabbed the microphone. He reviewed the newly minted NFTs as they appeared, laughing at the variable quality of the results but always providing his best sales pitch: This one looks great. Now, this is truly something avant-garde. Look at the curves on that one. The code attempts to balance unpredictability and quality, using a series of probability equations to determine the likelihood of characteristics like color, scale, and squiggle. The resulting psychedelic swirl of rectangles that Hobbs calls “flow fields” typically resemble the modernist block paintings of an artist like Piet Mondrian, only if someone dropping acid took a wet squeegee to his 1943 painting Broadway Boogie Woogie.

The new art slowly consumed the blank gallery walls as Hobbs kept pace, minting the NFTs, which were instantaneously assigned to collectors via the smart contracts that they had signed in the basement. The old-school artists who bore witness to the experiment were gobsmacked. “This is the art of our time,” said Tom Sachs, an artist who spearheaded his own financialized art movement almost thirty years ago by incorporating luxury brands like Hermès into sculptures of McDonald’s value meals. “This is the new avant-garde.”

Nobody within this audience of the crypto nouveau riche remembered what had occupied the empty storefront before the Bright Moments Gallery had taken over. Maybe it had once been a traditional gallery? Or maybe it was a Prada store? A furniture store? No, a grocery store? None of that really mattered anymore. The crypto hordes had found their own Rembrandt, and the digital art renaissance was beginning—not with a bang, but with a computerized beep.

__________________________________

From Token Supremacy: The Art of Finance, the Finance of Art, and the Great Crypto Crash of 2022 by Zachary Small. Copyright © 2024. Available from Alfred A. Knopf, an imprint of Knopf Doubleday Publishing Group, a division of Penguin Random House, LLC.

Nfts

NFTs Maintain Upward Momentum, Sales Volume Surpasses $107 Million

Non-fungible tokens, or NFTs, saw sales volume surge for the second week in a row, reaching $107 million, an increase of 8.5%.

A substantial increase in the number of NFT Buyers accompanied this growth, reaching 488,141 — a staggering increase of 89.56%.

On the other hand, the number of NFT sellers also increased by 69.8%, totaling 198,450, signaling an improved business environment and increased market engagement.

Below is a look at what happened in the NFT market over the past week.

Ethereum Maintains Leading Position While Solana and Bitcoin Follow

Blockchains by weekly NFT sales volume | Source: CryptoSlam

Over the past few weeks, Ethereum (ETH) continued to dominate the NFT market with $36.6 million in total sales, driven by 35,236 buyers, a 46.31% increase from the previous week.

Solana (GROUND) has emerged as a serious competitor, recording total revenue of $26.15 million, thanks to a substantial 114.07% increase in the number of buyers.

Bitcoin (Bitcoin) The NFT market also saw a notable surge, with total sales reaching $21.4 million, thanks to a staggering 222.29% increase in buyers.

Polygon (MATICS), which had the second best performance the previous week, saw its total sales volume drop by more than 15%, dropping it to 4th place just ahead of Immutable (IMX).

Other notable performances were achieved by Zora and Blast, which recorded the two largest percentage increases in sales volume, at 463% and 227% respectively.

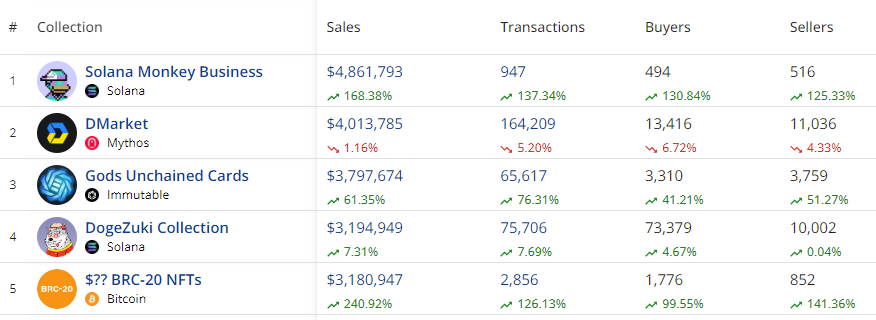

Best Collections: Solana Monkey Business Shines

Ranking NFT collections by weekly sales volume | Source: CryptoSlam

Ranking NFT collections by weekly sales volume | Source: CryptoSlam

Among the top NFT collections, Solana Monkey Business came out on top with $4.86 million in sales, an increase of 168.38%. The collection also saw a significant increase in transactions (137.34%) and buyers (130.84%).

The DMarket collection on the Mythos blockchain, which recorded $4.01 million in sales, came in a close second. Interestingly, this is the only collection among the top 5 by sales volume to see a decline in the number of transactions and buyers.

Immutable’s Gods Unchained cards also made headlines with $3.8 million in sales, an increase of 61.35%. This collection saw notable growth in both transactions (76.31%) and buyers (41.21%), a testament to the growing popularity of blockchain-based trading cards.

Best-Selling NFTs and Fan Tokens

In terms of individual sales, Ethereum’s Autoglyphs #167 led with a sale of $274,561, followed by Bitcoin’s Protoshrooms with $148,574. Other notable sales included BNB’s kNFT: Locked kUSDT and Arbitrum’s Umoja Synths, highlighting the diversity and breadth of the NFT market across different blockchains.

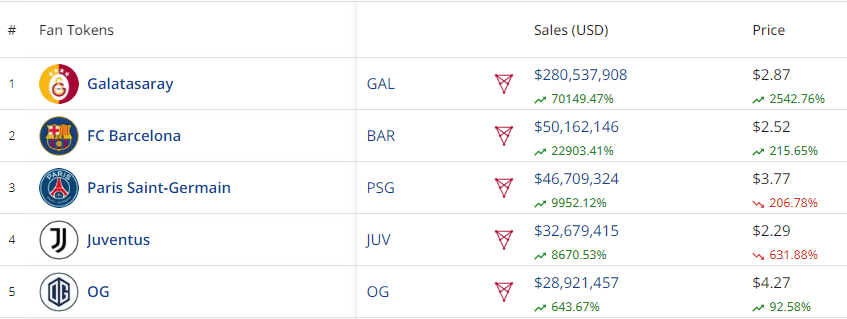

Top 5 Fan Tokens by Sales Volume

Top 5 Fan Tokens by Sales Volume

As can be seen in the table above CryptoSlamFan tokens also continued to see explosive growth, with Galatasaray’s token on the Chiliz blockchain recording a turnover of $280.5 million. This reflects an increase of 70149.47%.

FC Barcelona and Paris Saint-Germain followed with substantial sales volumes, indicating the growing popularity of sports-related NFTs.

Market consequences

The latest performance of the NFT market marks a significant turnaround, demonstrating resilience and renewed investor interest after a period of declining sales volumes.

This is the second consecutive week of improved sales, suggesting a potential upward trend. It is worth noting that this resurgence comes amid a broader recovery in the cryptocurrency market, which is currently valued at $2.55 trillion.

Major cryptocurrencies like Bitcoin, Ethereum, BNB, and Solana have all registered Prices have risen by double digits over the past week, further fueling optimism in the digital asset sector.

The correlation between rising cryptocurrency prices and the recovery of the NFT market could be an indication of strengthening investor confidence, setting a positive tone for the coming weeks.

Nfts

APENFT’s One-Day Trading Volume Hits $16.67 Million (NFT)

APENFT (NFT) fell 0.3% against the U.S. dollar in the 24-hour period ending at 9:00 a.m. ET on July 21. APENFT has a market cap of $8.54 million and $16.67 million worth of APENFT was traded on exchanges over the past day. Over the past week, APENFT has been trading 3.1% lower against the US Dollar. One APENFT token can now be purchased for around $0.0000 or 0.00000000 BTC on major cryptocurrency exchanges.

Here’s how other cryptocurrencies performed over the past day:

- KILT Protocol (KILT) is up 1.9% against the dollar and is now trading at $0.20 or 0.00000302 BTC.

- Aidi Finance (BSC) (AIDI) fell 2.2% against the dollar and is now trading at $0.0000 or 0.00000000 BTC.

- Zoo Token (ZOOT) fell 2.2% against the dollar and is now trading at $0.0652 or 0.00000239 BTC.

- CareCoin (CARES) fell 2.2% against the dollar and is now trading at $0.0809 or 0.00000297 BTC.

- Kitty Inu (KITTY) rose 1.9% against the dollar and is now trading at $95.84 or 0.00338062 BTC.

- Hokkaidu Inu (HOKK) rose 1.2% against the dollar and is now trading at $0.0004 or 0.00000001 BTC.

- Jeff in Space (JEFF) fell 2.2% against the dollar and is now trading at $2.75 or 0.00010076 BTC.

- Lumi Credits (LUMI) fell 0.7% against the dollar and is now trading at $0.0128 or 0.00000019 BTC.

- AXIA Coin (AXC) fell 0.1% against the dollar and is now trading at $13.43 or 0.00048094 BTC.

About APENFT

APENFT launched on March 28, 2021. The total supply of APENFT is 999,990,000,000,000 tokens and its circulating supply is 19,999,800,000,000 tokens. The official website of APENFT is apenft.orgThe official APENFT Twitter account is @apenftorg and his Facebook page is accessible here.

According to CryptoCompare, “APENFT is a blockchain-based platform created by the APENFT Foundation to create, buy, sell, and trade non-fungible tokens (NFTs) on the TRON and Ethereum networks. It allows for the ownership and trading of unique digital assets such as artwork, music, videos, and more. It also provides tools for artists and creators to create and promote their own NFTs, as well as participate in community events and governance.”

APENFT Token Trading

It is not currently generally possible to purchase alternative cryptocurrencies such as APENFT directly using US dollars. Investors wishing to acquire APENFT must first purchase Ethereum or Bitcoin using an exchange that deals in US dollars such as CoinbaseGDAX or Gemini. Investors can then use their newly acquired Ethereum or Bitcoin to purchase APENFT using any of the exchanges listed above.

Receive daily news and updates from APENFT – Enter your email address below to receive a concise daily summary of the latest news and updates for APENFT and associated cryptocurrencies with FREE CryptoBeat Newsletter from MarketBeat.com.

Nfts

Next US Vice President JD Vance Holds Bitcoin and NFTs, Expected to Boost MATIC and Algotech Post-Election

The blockchain technology landscape is about to transform as JD Vance, the likely next US vice president, emerges as a strong advocate for digital assets. Recent reports suggest that Vance not only holds Bitcoin (BTC) and NFTs, but is also willing to back promising blockchain initiatives like Polygon (MATIC) and Algotech (ALGT) post-elections.

JD Vance’s Cryptocurrency Investments Highlight Shift in Government Perspective

U.S. Senator JD Vance has garnered considerable attention for his recent investments in Bitcoin (BTC) and NFTs. Public records indicate that he owns between $100,000 and $250,000 worth of Bitcoin (BTC), indicating considerable interest in the success of the cryptocurrency market. This level of financial commitment from a high-profile government figure is unprecedented and underscores the growing credibility and promise of digital assets.

JD Vance’s interests extend beyond Bitcoin (BTC) to non-fungible tokens (NFTs), with reports suggesting his involvement in acquiring notable pieces from renowned collections. While the details of his NFT portfolio remain unknown, those who know the senator confirm his foray into this field.

This exploration of NFTs underscores Vance’s openness to exploring innovative and artistic applications of blockchain technology beyond cryptocurrencies’ typical role as assets or means of exchange. Vance’s involvement with cryptocurrency stands in stark contrast to the views of many of his peers in Congress, who often express doubt or hostility toward digital currency.

His direct involvement as an investor and user of these technologies gives him a unique perspective on their potential benefits and drawbacks. This practical understanding is likely to influence his stance on policy and regulation should he take on the role of vice president.

Polygon (MATIC) Hits $0.53, Eyes Breakout Amid Market Slowdown

The Vance administration, known for its support for cryptocurrencies, could significantly boost Polygon (MATIC), a major Ethereum layer 2 scaling project. MATIC has already attracted the attention of the developer community for its innovative solutions.

Even so, regulatory uncertainties have slowed widespread adoption and integration with traditional financial systems. Vance’s backing could serve as a driving force to unlock Polygon’s untapped capabilities.

A recent look at the MATIC token shows that its current trading value is $0.53, which represents an increase of over 2% in the last 24 hours. This surge coincides with a downturn in the broader cryptocurrency market, signaling solid fundamental strength and a growing sense of confidence among investors regarding Polygon’s future prospects.

Based on technical indicators, MATIC appears to be facing a resistance level that has persisted for several months, hinting at a potential breakout that could propel prices towards the previous peak around $1.29.

MATIC’s cutting-edge technology has taken a significant leap forward with the introduction of the Plonky3 zero-knowledge proof system. This innovation in zk-rollup technology is set to revolutionize MATIC’s scalability and efficiency, cementing its position as the premier choice for developers and enterprises.

Algotech (ALGT) Eyes $1 Price Hike When Its Exchange Launches

Algotech, a project that has attracted the interest of crypto enthusiasts and JD Vance, aims to transform algorithmic trading in the cryptocurrency space. Through the use of artificial intelligence and machine learning, Algotech offers advanced trading strategies to ordinary investors.

The platform’s innovative approach and ambitious roadmap are in line with JD Vance’s goal of driving financial innovation and making sophisticated investment tools more accessible to all. Algotech’s decentralized structure stands out, aligning perfectly with the core principles of blockchain technology.

By cutting out the middleman and giving users direct authority over their trading algorithms, Algotech embodies the essence of financial independence advocated by many in the crypto community, including Vance. This common ground makes Algotech a natural choice for endorsement by crypto-friendly leadership.

As Algotech’s pre-sale gains momentum, with over $9.6 million in funding, excitement is building for its official launch. Analysts have set lofty price targets, with some even suggesting that ALGT could surge to $1 shortly after it goes public.

While it’s wise to approach these predictions with caution, the combination of Algotech’s cutting-edge technology and the potential backing of key figures like JD Vance could pave the way for significant growth and adoption.

Learn more:

Disclaimer: This is a paid release. The statements, views, and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of Bitcoinist. Bitcoinist does not guarantee the accuracy or timeliness of any information available in this content. Do your research and invest at your own risk.

Nfts

OG Crypto Artist Trevor Jones Unveils Groundbreaking Collection of Ordinals | NFT CULTURE | NFT News | Web3 Culture

Trevor Jones’ New Genesis BTC Collection: CryptoAngels

Known for his innovative blend of physical and digital art, Trevor Jones continues to push the boundaries of the NFT space with his latest collection, CryptoAngels. Since his foray into Bitcoin-themed artwork in 2017, Jones has garnered a significant following, cementing his reputation with record-breaking sales and community events.

The Bitcoin Angel Journey

In 2021, Jones made headlines with his Bitcoin Angel open edition, selling 4,158 editions for an incredible $3.2 million in just seven minutes. This success paved the way for his latest venture, where he combines art, community, and technology in new ways. His annual Castle Parties, celebrating art, culture, and charity, have further cemented his place in the Web3 world.

CryptoAngels Collection Review

Jones’ CryptoAngels collection is divided into two main stages: Archangels and CryptoAngels.

- Step 1: The Archangels The initial phase, Archangels, saw 21 collector’s packages sold for 87.9 ETH (approximately $335,291). Each package included:

- A physical bronze sculpture of the Bitcoin angel

- A 3D NFT avatar

- An Archangel Ordinal

Esteemed collectors like ModeratsArt, Batsoupyum, Bharat Krymo, Blondie23LMD, and 1Confirmation now lead the CryptoAngel army as Archangel Collectors.

- Step 2: CryptoAngels The second phase, set to launch on August 7, features 7,777 unique CryptoAngels. These will be available for minting via OrdinalsBot, starting with a whitelisting phase. Each CryptoAngel is distinct and named by Jones himself. The collection is organized into 21 cohorts, each associated with one of Archangel’s collectors, fostering sub-communities within the larger collection. Additionally, there are seven 1/1 CryptoAngels, making them exceptionally rare and not aligned with a cohort.

Connecting Bitcoin and Art

Jones, who has been a strong Bitcoin supporter since mid-2017, expresses his deep connection to the crypto community. He sees the CryptoAngels collection as a tribute to that community, bringing his iconic Bitcoin Angel motif to the blockchain.

“I have been personally investing in Bitcoin since mid-2017 and its ethos quickly inspired me in my crypto art journey. I have followed the growth of Ordinals since its inception and the CryptoAngels collection is my offering to a community that has welcomed me with open arms and given me the opportunity to bring my Bitcoin Angel motif to the chain where it was always meant to be,” said artist Trevor Jones.

Collectors’ opinions

“Bitcoin’s OG artist Trevor Jones, behind the Bitcoin Angels depositing ordinals on the immutable chain is a match made in crypto-native art heaven.” – Bharat Krymo (@krybharat – Archangel Collector)

“The 2018 Bitcoin Angel oil painting is one of the first crypto tributes to Bitcoin, so CryptoAngels on Ordinals is a natural extension of Trevor’s artistic journey” – batsoupyum (Archangel Collector)

Interactive experience and limited editions

Rounding out the collection, 21 special Angels will be available to mint for $7 each on Base, playable in the exclusive retro arcade game, Dante’s Pixel Inferno. The game challenges players to guide their Angel through the nine circles of Fiat Hell, collecting Bitcoin and earning rewards. Each Angel in the game has unique abilities and weapons.

Whitelisting Opportunities and Community Engagement

Whitelisting (WL) opportunities are available through community partnerships, existing Bitcoin Angel OE and Trevor’s Ascended Angels holders, and weekly giveaways. To stay up to date and secure a spot on the whitelist, join Trevor Jones’ active Discord community.

TL;DR

Trevor Jones is launching the CryptoAngels collection on August 7th, building on his Bitcoin Angel legacy. Split into two stages, Archangels and CryptoAngels, the collection includes unique NFTs and physical artworks, fostering strong community connections. Exclusive gaming experiences and limited minting opportunities enhance engagement. Join the Discord for your chance to win.

-

Nfts11 months ago

Nfts11 months agoShardLab Launches ZK-Based Tool for Digital Identity and NFT Vouchers

-

News1 year ago

News1 year agoWallet recovery firms are abuzz as stranded cryptocurrency investors panic in the bitcoin boom

-

Bitcoin11 months ago

Bitcoin11 months agoBitcoin, Ethereum, Solana and Cryptocurrency Markets Look Ready to ‘Send’ as Stars Align, According to Investor Chris Burniske

-

Altcoins11 months ago

Altcoins11 months agoThree Altcoins Poised for Significant Growth in 2024: ETFS, OP, BLAST

-

Altcoins11 months ago

Altcoins11 months agoAccumulate these altcoins now for maximum gains

-

Nfts11 months ago

Nfts11 months agoOG Crypto Artist Trevor Jones Unveils Groundbreaking Collection of Ordinals | NFT CULTURE | NFT News | Web3 Culture

-

Bitcoin11 months ago

Bitcoin11 months agoBillionaires are selling Nvidia stock and buying an index fund that could rise as much as 5,655%, according to some Wall Street analysts

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!

-

Videos1 year ago

Videos1 year agoSTOCK MARKET FUD! ⚠️ [Why This Is GREAT For Bitcoin Traders!]

-

Videos1 year ago

Videos1 year agoAttention: a historically significant BITCOIN signal has just appeared!

-

News1 year ago

News1 year agoA Guide for Newcomers & Beginners – Forbes Advisor

-

Altcoins12 months ago

Altcoins12 months agoXRP, Shiba Inu, Cardano, Solana mega bounce imminent as Altcoin bottom remains strong ⋆ ZyCrypto