Nfts

Explainer: Do NFTs still offer value for the sports industry?

Sweet is the officially licensed digital collectible of the NHL. (NHL)

In 2022, North American ice hockey’s NHL entered the non-fungible token (NFT) market after striking a multi-year agreement with digital collectible platform Sweet.

Sweet is now the officially licensed digital collectible of the NHL, offering digital collectibles carved out of NHL highlights from past and present seasons, as well as a trading marketplace, and issuing both digital and real-life prizes via the NHL Breakaway platform, which launched last November.

According to the Forkast 500 NFT Index, a gauge for NFT market performance, the NFT market’s peak came in January 2022.

However, according to the same index, the market has been in decline ever since, now having only 23% of the value it had at its 2022 peak.

This raises the question of why so many major sports leagues and clubs such as the NHL, the EPCR (governing body and organizer of the European Rugby Champions Cup), and major English soccer clubs Manchester City and Newcastle United, have all signed or extended NFT deals (or digital collectibles as they are now more commonly known) in 2024, two years after the technology’s financial peak.

The answer – from a non-cynical perspective – seems to lie in efforts to increase fan engagement and internationalization in sports, rather than efforts to make speculative financial investments.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

Country *

UK

USA

Afghanistan

Åland Islands

Albania

Algeria

American Samoa

Andorra

Angola

Anguilla

Antarctica

Antigua and Barbuda

Argentina

Armenia

Aruba

Australia

Austria

Azerbaijan

Bahamas

Bahrain

Bangladesh

Barbados

Belarus

Belgium

Belize

Benin

Bermuda

Bhutan

Bolivia

Bonaire, Sint

Eustatius

and

Saba

Bosnia and Herzegovina

Botswana

Bouvet Island

Brazil

British Indian Ocean

Territory

Brunei Darussalam

Bulgaria

Burkina Faso

Burundi

Cambodia

Cameroon

Canada

Cape Verde

Cayman Islands

Central African Republic

Chad

Chile

China

Christmas Island

Cocos Islands

Colombia

Comoros

Congo

Democratic Republic

of

the Congo

Cook Islands

Costa Rica

Côte d”Ivoire

Croatia

Cuba

Curaçao

Cyprus

Czech Republic

Denmark

Djibouti

Dominica

Dominican Republic

Ecuador

Egypt

El Salvador

Equatorial Guinea

Eritrea

Estonia

Ethiopia

Falkland Islands

Faroe Islands

Fiji

Finland

France

French Guiana

French Polynesia

French Southern

Territories

Gabon

Gambia

Georgia

Germany

Ghana

Gibraltar

Greece

Greenland

Grenada

Guadeloupe

Guam

Guatemala

Guernsey

Guinea

Guinea-Bissau

Guyana

Haiti

Heard Island and

McDonald

Islands

Holy See

Honduras

Hong Kong

Hungary

Iceland

India

Indonesia

Iran

Iraq

Ireland

Isle of Man

Israel

Italy

Jamaica

Japan

Jersey

Jordan

Kazakhstan

Kenya

Kiribati

North Korea

South Korea

Kuwait

Kyrgyzstan

Lao

Latvia

Lebanon

Lesotho

Liberia

Libyan Arab Jamahiriya

Liechtenstein

Lithuania

Luxembourg

Macao

Macedonia,

The

Former

Yugoslav Republic of

Madagascar

Malawi

Malaysia

Maldives

Mali

Malta

Marshall Islands

Martinique

Mauritania

Mauritius

Mayotte

Mexico

Micronesia

Moldova

Monaco

Mongolia

Montenegro

Montserrat

Morocco

Mozambique

Myanmar

Namibia

Nauru

Nepal

Netherlands

New Caledonia

New Zealand

Nicaragua

Niger

Nigeria

Niue

Norfolk Island

Northern Mariana Islands

Norway

Oman

Pakistan

Palau

Palestinian Territory

Panama

Papua New Guinea

Paraguay

Peru

Philippines

Pitcairn

Poland

Portugal

Puerto Rico

Qatar

Réunion

Romania

Russian Federation

Rwanda

Saint

Helena,

Ascension and Tristan da Cunha

Saint Kitts and Nevis

Saint Lucia

Saint Pierre and Miquelon

Saint Vincent and

The

Grenadines

Samoa

San Marino

Sao Tome and Principe

Saudi Arabia

Senegal

Serbia

Seychelles

Sierra Leone

Singapore

Slovakia

Slovenia

Solomon Islands

Somalia

South Africa

South

Georgia

and The South

Sandwich Islands

Spain

Sri Lanka

Sudan

Suriname

Svalbard and Jan Mayen

Swaziland

Sweden

Switzerland

Syrian Arab Republic

Taiwan

Tajikistan

Tanzania

Thailand

Timor-Leste

Togo

Tokelau

Tonga

Trinidad and Tobago

Tunisia

Turkey

Turkmenistan

Turks and Caicos Islands

Tuvalu

Uganda

Ukraine

United Arab Emirates

US Minor Outlying Islands

Uruguay

Uzbekistan

Vanuatu

Venezuela

Vietnam

British Virgin Islands

US Virgin Islands

Wallis and Futuna

Western Sahara

Yemen

Zambia

Zimbabwe

Kosovo

Industry *

Academia & Education

Aerospace, Defense &

Security

Agriculture

Asset Management

Automotive

Banking & Payments

Chemicals

Construction

Consumer

Foodservice

Government, trade bodies

and NGOs

Health & Fitness

Hospitals & Healthcare

HR, Staffing &

Recruitment

Insurance

Investment Banking

Legal Services

Management Consulting

Marketing & Advertising

Media & Publishing

Medical Devices

Mining

Oil & Gas

Packaging

Pharmaceuticals

Power & Utilities

Private Equity

Real Estate

Retail

Sport

Technology

Telecom

Transportation &

Logistics

Travel, Tourism &

Hospitality

Venture Capital

Tick here to opt out of curated industry news, reports, and event updates from Sportcal.

Submit and

download

Visit our Privacy Policy for more information about our services, how we may use, process and share your personal data, including information of your rights in respect of your personal data and how you can unsubscribe from future marketing communications. Our services are intended for corporate subscribers and you warrant that the email address submitted is your corporate email address.

Jason Runnion, vice president of marketing at Sweet, has noticed this change in the NFT space over the last two years, and explains his thought process in an extensive interview with GlobalData Sport (Sportcal).

As he explains: “Things won’t necessarily go back to the way they were.

“The goal wasn’t to come out of the gate and say ‘here’s another speculative project like any other projects that you might have already participated in’, the goal was to say we’re working in close partnership with the NHL, the partners, the players’ association, to develop a product on our platform that fans will actually enjoy.”

How to achieve NFT mass adoption

Given this move away from seeing NFTs as a speculative investment, and more as a fun digital collectible for fans, companies in this space have had to change their approach to marketing, with less focus on web3 terminology and education around web3, replacing it with more focus on attracting your average sports viewer.

The focus for the consumer is now less on making money by owning NFTs, and more on engaging in a digital counterpart to sports card collecting.

Laith Murad, chief marketing officer at Sweet, clarifies: “Crypto blockchain technology, that’s just the underlying technology. That underlying technology was never the focus. It’s about the players, content, and teams. That’s what fans are interested in.”

Runnion adds: “A lot of people in the web3 space talk about mass adoption, and how to get more people into web3. How you do that isn’t by talking about web3, blockchain, and technology, in the same way that I don’t get hooked on the latest streaming service by telling you about how amazing it is that Netflix is on Amazon Web Services.

“I just show you the content that’s on Netflix. It’s the same [in our industry] – not talking about web3, or blockchain, although those are important structures that underpin our platform. Especially in a nascent space like this, it’s important to increasingly engage the everyday fan with the content and next generation of highlights.”

Fan engagement

One such way that companies like Sweet envision digital collectibles increasing fan engagement is by undertaking the usual activities that come with physical collectibles, but then extending their reach past physical barriers, allowing fans to interact with their teams and each other globally.

Digital collectible companies say they see the space as an opportunity to create fan communities across borders, which comes amid various sports’ internationalization efforts.

The NHL is one of those sporting properties focused on internationalization, with the US league having a 2024 NHL Global Series Challenge, staging matches in Germany on September 27, the Czech Republic between October 4 and 5, and in Finland from November 1 to 2, which seems to suggest a clear appetite for global expansion.

Murad explains: “I have friends who were in the hockey space, but they no longer live near me. So, I can’t just hand over the cards and trade. But now I can do it [digitally].

“So it’s this whole idea that I can start trading with people in London who are hockey fans and they can be a part of the community. That’s something really important, the community element of these fans coming together. That when you become a part of this – you’re not just an individual, you’re a part of a community of hockey-loving fans who are looking to collect and talk about the game, and you have a place to go. That’s unique.”

Challenges

Despite all of this, the market is not yet at the mass adoption stage, with those in the digital collectibles space still having trouble attracting regular fans who are not interested in collectibles, but are simply traditional ice hockey fans.

Many supporters, while used to buying physical items such as team jerseys, are either not familiar with the idea of digital collectibles, don’t understand it, or have simply been put off by the wave of (sometimes self-inflicted) bad publicity in the sector post-2022.

While NFTs were technically first invented in 2014, the technology was still very much in development, with Ethereum integration (now the standard) happening in 2015, and the market not gaining popularity until 2021, when it became popular in the art world.

This was the same year that US basketball giants the Golden State Warriors became the first sports team to release its own range of licensed NFTs, meaning the specific market has only technically existed for three years.

Murad explains: “If you look at our platform , it’s early stages. Some of the challenges that affect the entire market are as a result of the fact that sports digital collectibles as a whole are still in the early stages, despite the fact that there was a boom a few years ago.

“As a fan you want to show off your colors and your fandom. Often that means you’re buying a jersey, hat, sweatshirt, or something of that sort. The idea now is that all these moments have gone digital.

“We have to help educate, on a macro level, the entire industry, so that’s always going to be a challenge until we get there. But we’re really confident that if you look at the space of digital collectibles, sports is where there’s a huge opportunity. Sports is where we believe the mass adoption will come from, and that’s because fans like to relive the moments in their head.

Murad believes that while “the collectors have woken up to it, the mass market of fans who go and turn on the television on Saturdays and Sundays to watch, are not there yet.”

He concludes: “They’ll get there. We’re 100% confident they’ll be there. It’s just a matter of learning and adjusting to this notion that these memories are collected on your phone, digitally.”

Sign up for our daily news round-up!

Nfts

NFTs Maintain Upward Momentum, Sales Volume Surpasses $107 Million

Non-fungible tokens, or NFTs, saw sales volume surge for the second week in a row, reaching $107 million, an increase of 8.5%.

A substantial increase in the number of NFT Buyers accompanied this growth, reaching 488,141 — a staggering increase of 89.56%.

On the other hand, the number of NFT sellers also increased by 69.8%, totaling 198,450, signaling an improved business environment and increased market engagement.

Below is a look at what happened in the NFT market over the past week.

Ethereum Maintains Leading Position While Solana and Bitcoin Follow

Blockchains by weekly NFT sales volume | Source: CryptoSlam

Over the past few weeks, Ethereum (ETH) continued to dominate the NFT market with $36.6 million in total sales, driven by 35,236 buyers, a 46.31% increase from the previous week.

Solana (GROUND) has emerged as a serious competitor, recording total revenue of $26.15 million, thanks to a substantial 114.07% increase in the number of buyers.

Bitcoin (Bitcoin) The NFT market also saw a notable surge, with total sales reaching $21.4 million, thanks to a staggering 222.29% increase in buyers.

Polygon (MATICS), which had the second best performance the previous week, saw its total sales volume drop by more than 15%, dropping it to 4th place just ahead of Immutable (IMX).

Other notable performances were achieved by Zora and Blast, which recorded the two largest percentage increases in sales volume, at 463% and 227% respectively.

Best Collections: Solana Monkey Business Shines

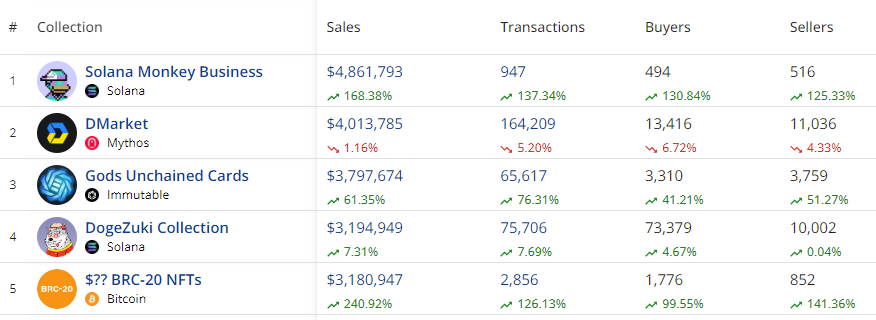

Ranking NFT collections by weekly sales volume | Source: CryptoSlam

Ranking NFT collections by weekly sales volume | Source: CryptoSlam

Among the top NFT collections, Solana Monkey Business came out on top with $4.86 million in sales, an increase of 168.38%. The collection also saw a significant increase in transactions (137.34%) and buyers (130.84%).

The DMarket collection on the Mythos blockchain, which recorded $4.01 million in sales, came in a close second. Interestingly, this is the only collection among the top 5 by sales volume to see a decline in the number of transactions and buyers.

Immutable’s Gods Unchained cards also made headlines with $3.8 million in sales, an increase of 61.35%. This collection saw notable growth in both transactions (76.31%) and buyers (41.21%), a testament to the growing popularity of blockchain-based trading cards.

Best-Selling NFTs and Fan Tokens

In terms of individual sales, Ethereum’s Autoglyphs #167 led with a sale of $274,561, followed by Bitcoin’s Protoshrooms with $148,574. Other notable sales included BNB’s kNFT: Locked kUSDT and Arbitrum’s Umoja Synths, highlighting the diversity and breadth of the NFT market across different blockchains.

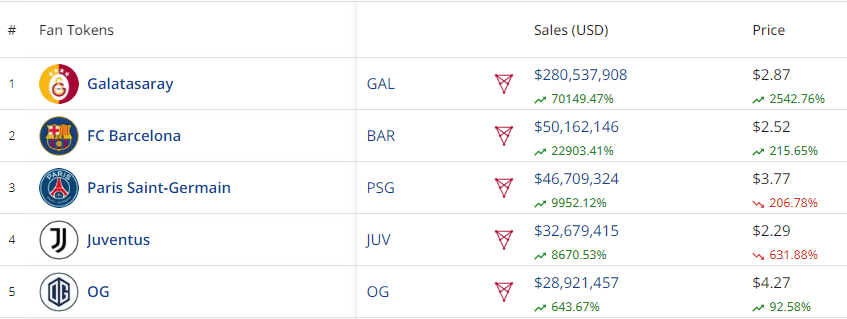

Top 5 Fan Tokens by Sales Volume

Top 5 Fan Tokens by Sales Volume

As can be seen in the table above CryptoSlamFan tokens also continued to see explosive growth, with Galatasaray’s token on the Chiliz blockchain recording a turnover of $280.5 million. This reflects an increase of 70149.47%.

FC Barcelona and Paris Saint-Germain followed with substantial sales volumes, indicating the growing popularity of sports-related NFTs.

Market consequences

The latest performance of the NFT market marks a significant turnaround, demonstrating resilience and renewed investor interest after a period of declining sales volumes.

This is the second consecutive week of improved sales, suggesting a potential upward trend. It is worth noting that this resurgence comes amid a broader recovery in the cryptocurrency market, which is currently valued at $2.55 trillion.

Major cryptocurrencies like Bitcoin, Ethereum, BNB, and Solana have all registered Prices have risen by double digits over the past week, further fueling optimism in the digital asset sector.

The correlation between rising cryptocurrency prices and the recovery of the NFT market could be an indication of strengthening investor confidence, setting a positive tone for the coming weeks.

Nfts

APENFT’s One-Day Trading Volume Hits $16.67 Million (NFT)

APENFT (NFT) fell 0.3% against the U.S. dollar in the 24-hour period ending at 9:00 a.m. ET on July 21. APENFT has a market cap of $8.54 million and $16.67 million worth of APENFT was traded on exchanges over the past day. Over the past week, APENFT has been trading 3.1% lower against the US Dollar. One APENFT token can now be purchased for around $0.0000 or 0.00000000 BTC on major cryptocurrency exchanges.

Here’s how other cryptocurrencies performed over the past day:

- KILT Protocol (KILT) is up 1.9% against the dollar and is now trading at $0.20 or 0.00000302 BTC.

- Aidi Finance (BSC) (AIDI) fell 2.2% against the dollar and is now trading at $0.0000 or 0.00000000 BTC.

- Zoo Token (ZOOT) fell 2.2% against the dollar and is now trading at $0.0652 or 0.00000239 BTC.

- CareCoin (CARES) fell 2.2% against the dollar and is now trading at $0.0809 or 0.00000297 BTC.

- Kitty Inu (KITTY) rose 1.9% against the dollar and is now trading at $95.84 or 0.00338062 BTC.

- Hokkaidu Inu (HOKK) rose 1.2% against the dollar and is now trading at $0.0004 or 0.00000001 BTC.

- Jeff in Space (JEFF) fell 2.2% against the dollar and is now trading at $2.75 or 0.00010076 BTC.

- Lumi Credits (LUMI) fell 0.7% against the dollar and is now trading at $0.0128 or 0.00000019 BTC.

- AXIA Coin (AXC) fell 0.1% against the dollar and is now trading at $13.43 or 0.00048094 BTC.

About APENFT

APENFT launched on March 28, 2021. The total supply of APENFT is 999,990,000,000,000 tokens and its circulating supply is 19,999,800,000,000 tokens. The official website of APENFT is apenft.orgThe official APENFT Twitter account is @apenftorg and his Facebook page is accessible here.

According to CryptoCompare, “APENFT is a blockchain-based platform created by the APENFT Foundation to create, buy, sell, and trade non-fungible tokens (NFTs) on the TRON and Ethereum networks. It allows for the ownership and trading of unique digital assets such as artwork, music, videos, and more. It also provides tools for artists and creators to create and promote their own NFTs, as well as participate in community events and governance.”

APENFT Token Trading

It is not currently generally possible to purchase alternative cryptocurrencies such as APENFT directly using US dollars. Investors wishing to acquire APENFT must first purchase Ethereum or Bitcoin using an exchange that deals in US dollars such as CoinbaseGDAX or Gemini. Investors can then use their newly acquired Ethereum or Bitcoin to purchase APENFT using any of the exchanges listed above.

Receive daily news and updates from APENFT – Enter your email address below to receive a concise daily summary of the latest news and updates for APENFT and associated cryptocurrencies with FREE CryptoBeat Newsletter from MarketBeat.com.

Nfts

Next US Vice President JD Vance Holds Bitcoin and NFTs, Expected to Boost MATIC and Algotech Post-Election

The blockchain technology landscape is about to transform as JD Vance, the likely next US vice president, emerges as a strong advocate for digital assets. Recent reports suggest that Vance not only holds Bitcoin (BTC) and NFTs, but is also willing to back promising blockchain initiatives like Polygon (MATIC) and Algotech (ALGT) post-elections.

JD Vance’s Cryptocurrency Investments Highlight Shift in Government Perspective

U.S. Senator JD Vance has garnered considerable attention for his recent investments in Bitcoin (BTC) and NFTs. Public records indicate that he owns between $100,000 and $250,000 worth of Bitcoin (BTC), indicating considerable interest in the success of the cryptocurrency market. This level of financial commitment from a high-profile government figure is unprecedented and underscores the growing credibility and promise of digital assets.

JD Vance’s interests extend beyond Bitcoin (BTC) to non-fungible tokens (NFTs), with reports suggesting his involvement in acquiring notable pieces from renowned collections. While the details of his NFT portfolio remain unknown, those who know the senator confirm his foray into this field.

This exploration of NFTs underscores Vance’s openness to exploring innovative and artistic applications of blockchain technology beyond cryptocurrencies’ typical role as assets or means of exchange. Vance’s involvement with cryptocurrency stands in stark contrast to the views of many of his peers in Congress, who often express doubt or hostility toward digital currency.

His direct involvement as an investor and user of these technologies gives him a unique perspective on their potential benefits and drawbacks. This practical understanding is likely to influence his stance on policy and regulation should he take on the role of vice president.

Polygon (MATIC) Hits $0.53, Eyes Breakout Amid Market Slowdown

The Vance administration, known for its support for cryptocurrencies, could significantly boost Polygon (MATIC), a major Ethereum layer 2 scaling project. MATIC has already attracted the attention of the developer community for its innovative solutions.

Even so, regulatory uncertainties have slowed widespread adoption and integration with traditional financial systems. Vance’s backing could serve as a driving force to unlock Polygon’s untapped capabilities.

A recent look at the MATIC token shows that its current trading value is $0.53, which represents an increase of over 2% in the last 24 hours. This surge coincides with a downturn in the broader cryptocurrency market, signaling solid fundamental strength and a growing sense of confidence among investors regarding Polygon’s future prospects.

Based on technical indicators, MATIC appears to be facing a resistance level that has persisted for several months, hinting at a potential breakout that could propel prices towards the previous peak around $1.29.

MATIC’s cutting-edge technology has taken a significant leap forward with the introduction of the Plonky3 zero-knowledge proof system. This innovation in zk-rollup technology is set to revolutionize MATIC’s scalability and efficiency, cementing its position as the premier choice for developers and enterprises.

Algotech (ALGT) Eyes $1 Price Hike When Its Exchange Launches

Algotech, a project that has attracted the interest of crypto enthusiasts and JD Vance, aims to transform algorithmic trading in the cryptocurrency space. Through the use of artificial intelligence and machine learning, Algotech offers advanced trading strategies to ordinary investors.

The platform’s innovative approach and ambitious roadmap are in line with JD Vance’s goal of driving financial innovation and making sophisticated investment tools more accessible to all. Algotech’s decentralized structure stands out, aligning perfectly with the core principles of blockchain technology.

By cutting out the middleman and giving users direct authority over their trading algorithms, Algotech embodies the essence of financial independence advocated by many in the crypto community, including Vance. This common ground makes Algotech a natural choice for endorsement by crypto-friendly leadership.

As Algotech’s pre-sale gains momentum, with over $9.6 million in funding, excitement is building for its official launch. Analysts have set lofty price targets, with some even suggesting that ALGT could surge to $1 shortly after it goes public.

While it’s wise to approach these predictions with caution, the combination of Algotech’s cutting-edge technology and the potential backing of key figures like JD Vance could pave the way for significant growth and adoption.

Learn more:

Disclaimer: This is a paid release. The statements, views, and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of Bitcoinist. Bitcoinist does not guarantee the accuracy or timeliness of any information available in this content. Do your research and invest at your own risk.

Nfts

OG Crypto Artist Trevor Jones Unveils Groundbreaking Collection of Ordinals | NFT CULTURE | NFT News | Web3 Culture

Trevor Jones’ New Genesis BTC Collection: CryptoAngels

Known for his innovative blend of physical and digital art, Trevor Jones continues to push the boundaries of the NFT space with his latest collection, CryptoAngels. Since his foray into Bitcoin-themed artwork in 2017, Jones has garnered a significant following, cementing his reputation with record-breaking sales and community events.

The Bitcoin Angel Journey

In 2021, Jones made headlines with his Bitcoin Angel open edition, selling 4,158 editions for an incredible $3.2 million in just seven minutes. This success paved the way for his latest venture, where he combines art, community, and technology in new ways. His annual Castle Parties, celebrating art, culture, and charity, have further cemented his place in the Web3 world.

CryptoAngels Collection Review

Jones’ CryptoAngels collection is divided into two main stages: Archangels and CryptoAngels.

- Step 1: The Archangels The initial phase, Archangels, saw 21 collector’s packages sold for 87.9 ETH (approximately $335,291). Each package included:

- A physical bronze sculpture of the Bitcoin angel

- A 3D NFT avatar

- An Archangel Ordinal

Esteemed collectors like ModeratsArt, Batsoupyum, Bharat Krymo, Blondie23LMD, and 1Confirmation now lead the CryptoAngel army as Archangel Collectors.

- Step 2: CryptoAngels The second phase, set to launch on August 7, features 7,777 unique CryptoAngels. These will be available for minting via OrdinalsBot, starting with a whitelisting phase. Each CryptoAngel is distinct and named by Jones himself. The collection is organized into 21 cohorts, each associated with one of Archangel’s collectors, fostering sub-communities within the larger collection. Additionally, there are seven 1/1 CryptoAngels, making them exceptionally rare and not aligned with a cohort.

Connecting Bitcoin and Art

Jones, who has been a strong Bitcoin supporter since mid-2017, expresses his deep connection to the crypto community. He sees the CryptoAngels collection as a tribute to that community, bringing his iconic Bitcoin Angel motif to the blockchain.

“I have been personally investing in Bitcoin since mid-2017 and its ethos quickly inspired me in my crypto art journey. I have followed the growth of Ordinals since its inception and the CryptoAngels collection is my offering to a community that has welcomed me with open arms and given me the opportunity to bring my Bitcoin Angel motif to the chain where it was always meant to be,” said artist Trevor Jones.

Collectors’ opinions

“Bitcoin’s OG artist Trevor Jones, behind the Bitcoin Angels depositing ordinals on the immutable chain is a match made in crypto-native art heaven.” – Bharat Krymo (@krybharat – Archangel Collector)

“The 2018 Bitcoin Angel oil painting is one of the first crypto tributes to Bitcoin, so CryptoAngels on Ordinals is a natural extension of Trevor’s artistic journey” – batsoupyum (Archangel Collector)

Interactive experience and limited editions

Rounding out the collection, 21 special Angels will be available to mint for $7 each on Base, playable in the exclusive retro arcade game, Dante’s Pixel Inferno. The game challenges players to guide their Angel through the nine circles of Fiat Hell, collecting Bitcoin and earning rewards. Each Angel in the game has unique abilities and weapons.

Whitelisting Opportunities and Community Engagement

Whitelisting (WL) opportunities are available through community partnerships, existing Bitcoin Angel OE and Trevor’s Ascended Angels holders, and weekly giveaways. To stay up to date and secure a spot on the whitelist, join Trevor Jones’ active Discord community.

TL;DR

Trevor Jones is launching the CryptoAngels collection on August 7th, building on his Bitcoin Angel legacy. Split into two stages, Archangels and CryptoAngels, the collection includes unique NFTs and physical artworks, fostering strong community connections. Exclusive gaming experiences and limited minting opportunities enhance engagement. Join the Discord for your chance to win.

-

Nfts1 year ago

Nfts1 year agoShardLab Launches ZK-Based Tool for Digital Identity and NFT Vouchers

-

News1 year ago

News1 year agoWallet recovery firms are abuzz as stranded cryptocurrency investors panic in the bitcoin boom

-

Bitcoin1 year ago

Bitcoin1 year agoBitcoin, Ethereum, Solana and Cryptocurrency Markets Look Ready to ‘Send’ as Stars Align, According to Investor Chris Burniske

-

Altcoins1 year ago

Altcoins1 year agoThree Altcoins Poised for Significant Growth in 2024: ETFS, OP, BLAST

-

Altcoins1 year ago

Altcoins1 year agoAccumulate these altcoins now for maximum gains

-

Nfts1 year ago

Nfts1 year agoOG Crypto Artist Trevor Jones Unveils Groundbreaking Collection of Ordinals | NFT CULTURE | NFT News | Web3 Culture

-

Bitcoin1 year ago

Bitcoin1 year agoBillionaires are selling Nvidia stock and buying an index fund that could rise as much as 5,655%, according to some Wall Street analysts

-

Videos9 months ago

Videos9 months agoKamala just won the boner! [Bad For Crypto]

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!

-

News1 year ago

News1 year agoA Guide for Newcomers & Beginners – Forbes Advisor

-

Videos1 year ago

Videos1 year agoAttention: a historically significant BITCOIN signal has just appeared!

-

Videos1 year ago

Videos1 year agoSTOCK MARKET FUD! ⚠️ [Why This Is GREAT For Bitcoin Traders!]