Bitcoin

Bitcoin Creates New Environmental Injustices for Black Texas

Bitcoin is more than just a shiny new way to lose money. It’s also fueling Texas’ energy woes as the state braces for another year of record-breaking heat. And communities of color are caught in the crosshairs of climate change, those sprawling data centers, and the power plants needed to meet both demands.

Last year, during the deadliest summer in Texas history, Black people bore the brunt of the heat. Stories like the deaths of a 5-day-old Black infant and a 66-year-old Black postal worker from heat illness led to national indignation. The brutal summer only fueled the fire that the state’s power grid operator, the Electric Reliability Council of Texas, has spent years trying to put out.

After a 2021 winter storm revealed just how unprepared the state was for severe weather, Texas was searching for ways to ensure it would be producing enough electricity in times of disaster.

Their solution: new fossil fuel-powered power plants.

But while the state says these new power plants meet demand caused by severe weather and population growth, a new ERCOT Forecast says that as the state’s energy demand doubles over the next six years, most of the demand will come from water and energy consumer data centers for artificial intelligence supercomputers and cryptography processing.

Essentially, this means the state is building polluting power plants that have historically decimated black communities, in part for industries that experts say are increasing economic inequality and discrimination against black Americans.

Despite analysis showing that clean energy sources such as wind and solar are far more reliable and cheaper to produce than energy from fossil fuels, in the aftermath of last summer the state decided to subsidize New gas-fired power plants worth $10 billion.

Across the country, low-income black people are most exposed to pollution from power plants and have the higher risk of death of such pollution. In Texas, more than 75 percent of the state’s gas-fired power plants are in areas where the population has a higher-than-average share of people of color, according to a Capital B analysis of EPA data.

Early documents reviewed by Capital B show that the trend of placing these facilities in communities of color may continue. Of the companies that requested financing and stated that where they would build new factories, about half, or 45 percent, would be in communities with above-average black populations.

“They’re trying to use these ‘volatile’ weather events, the freezing and the heat, as justification for all these new gas plants,” Brittney Stredic told Capital B last year. She’s part of a coalition of community members who have been fighting for a new gas plant and pipeline in her Houston neighborhood for several years. “But we don’t need it.”

Read more: A gas storage plant and new pipeline disrupt life in this black community

Although Texas has recently established itself as the emerging country US renewable energy capitalThese measures signal a setback for the state — and for the climate.

Climate change and the intensified nature of winter and summer are largely caused by the burning of fossil fuels. And Texas’ response is to align itself with industries that have been shown to harm Black communities, experts say.

“There are so many downsides to cryptocurrencies, but unfortunately, the industry has a lot of money, and recently it has been using its money to get favorable policies in Washington, D.C., and places like Texas,” said Algernon Austin, director of Race and Economic Justice at the Center for Economic and Policy Research. Austin has spent years researching how the speculative get-rich-quick scheme targets the country’s most vulnerable.

“Cryptocurrencies are a shiny new way to lose money. The analysis that has been done suggests that, if anything, it has worked to increase inequality,” he added. “It is worrying that it is creating an environmental problem on top of all this.”

Artificial intelligence and cryptomining are immensely energy- and water-intensive due to the power required to process complex algorithms and transactions. As these supercomputers, which are typically three times the size of an average U.S. home, operate, they generate enormous amounts of heat that require continuous cooling — and demand for electricity.

Texas already consumes more energy than any other state, and the pollution from that consumption is palpable. Despite being home to 9 percent of the nation’s population, the state is responsible for 13 percent of all pollution from power plants and 15 percent of all pollution from natural gas plants.

The get-rich-quick mentality

It’s not Texas’ fault that the country’s new state passion for these energy intensive uses of the Internet is driving the need for energy. The energy required to run a single AI search, for example, is between 10 and 30 times the energy required to run a traditional Google search. However, its continued drive to attract business above almost all other considerations can be credited to the state.

Texas residents and experts say that in many ways, the state’s energy woes are driven by a get-rich-quick mentality that prioritizes attractive deals over the resulting strain on the power grid, water sources and rapid population growth.

But the state’s plight exemplifies the crossroads the country finds itself at as it tries to strengthen its power grids: one that can support the most vulnerable populations, like communities of color living near fossil fuel-fired power plants, or align itself with industries that further exacerbate the problems.

Entergy CEO and President Eliecer Viamontes cited that statewide desire as a reason behind his company’s decision to build new fossil fuel power plants in Texas. His company is one of two that have filed applications to open new gas-fired power plants in a predominantly Black and Latino suburb of Houston, where some neighborhoods already face cancer risks from air pollution 46 times higher than federal limits.

“We have to think about how this aligns with what the leadership of the state of Texas is pushing, which is that we have to be the number one state for business, the number one state for economic growth,” Viamontes he said. Without the new plants, he said, “There is a risk of losing economic growth in the region.”

But economic growth for whom, Austin wonders. The rise in cryptofinance in particular, a tool initially marketed as a way to reduce economic inequality, shows that mindset can work directly against improving lives in Black communities.

As state residents were hit by triple-digit heat in August, the grid operator gave millions of dollars for Bitcoin mining and data center companies to stop using so much energy. It’s a tactic Texas may have to use again for several summers to come. (To keep air conditioning running, that summer the state also obtained an emergency order from the U.S. Department of Energy allowing power plants to exceed pollution limits to produce more energy. That left communities of color facing the dual threat of suffocating heat and air pollution.)

“We’ve been incredibly misinformed because our local leaders haven’t made it a priority to talk to us about what’s going on,” said Kimberlee Walter, an activist in a Texas community that’s home to a crypto finance company that received $32 million last summer to use less energy. “These companies are wasting precious resources, driving up our energy bills and destabilizing an already very unstable grid.”

Meanwhile, in recent years, research has found that black people are more probable than white people to invest in cryptocurrencies and are more likely to incorrectly believe that the industry is regulated and safe. Black crypto investors are also more likely than white crypto investors to say they have borrowed money to make their investments.

Cryptocurrency has also increased costs for those who haven’t even invested in the coin. In Texas, it has already increased electricity costs for non-mining Texans by $1.8 billion a year, or 4.7%, according to conservative estimates from consulting firm Wood Mackenzie.

A large portion of these crypto mines have opened around the Dallas metro area, which is among the fastest-growing places for black people and is already home to 1.2 million black people. At least one of the new fossil fuel power plants proposed in a predominantly black community would be built exclusively to power a cryptomining supercomputer.

A natural gas plant lights up the sky near a 90 percent black neighborhood in Beaumont, Texas. (Adam Mahoney/Capital B)

A natural gas plant lights up the sky near a 90 percent black neighborhood in Beaumont, Texas. (Adam Mahoney/Capital B)

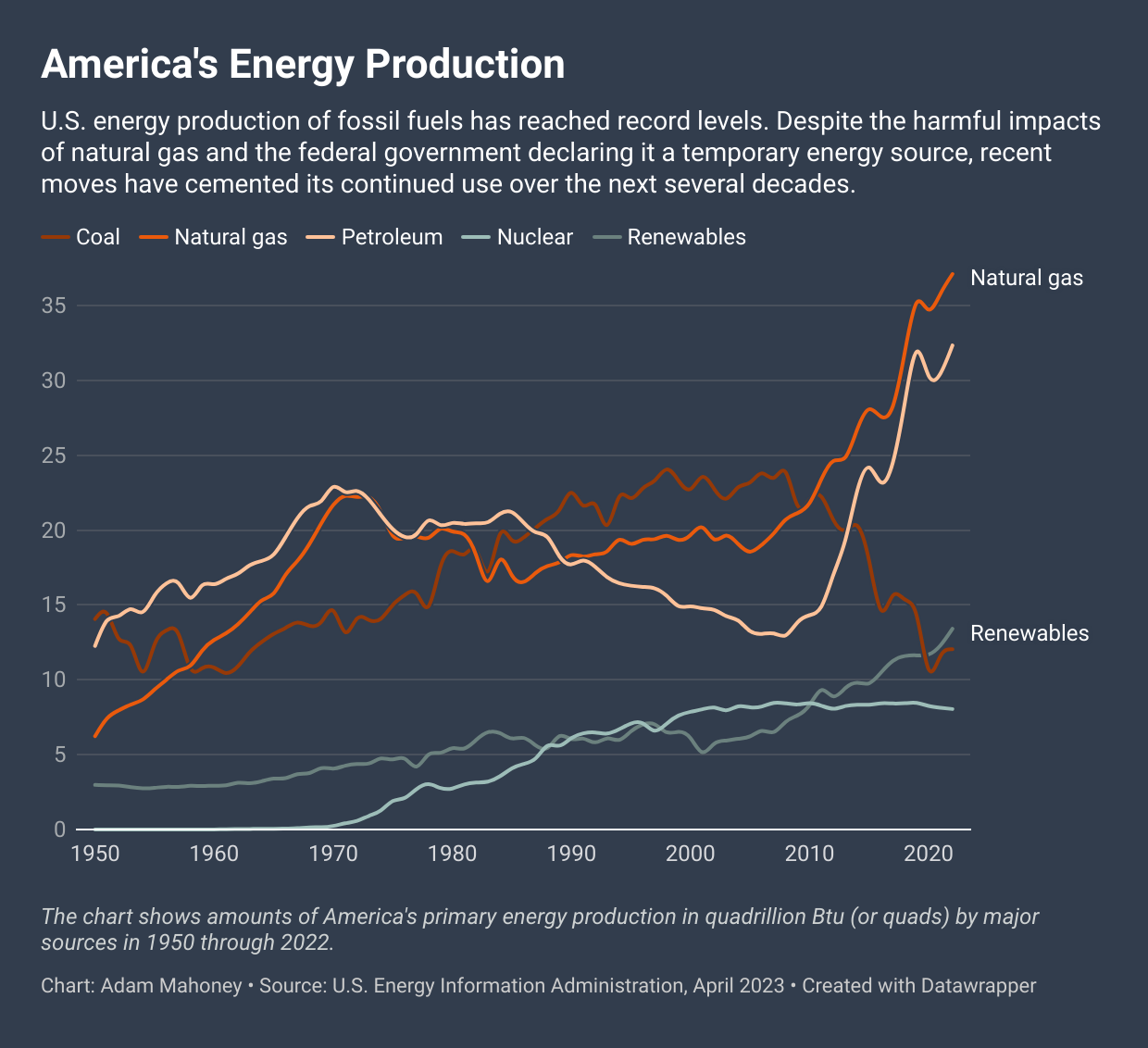

As natural gas production surges across the country, energy companies and government agencies are not “adequately addressing the history of the devastation that oil and gas have wrought in the Gulf South and communities of color,” said Robert Bullard, the father of environmental justice.

While clean energy is growing, Texas has a problem getting it to homes. The growth of renewable energy requires expensive transmission lines to move power to urban consumers from rural areas where wind and solar farms are located. But some residents believe the cost and infrastructure construction are worth it.

“The truth is that gas failed us when we needed it most,” the state’s Sierra Club chapter wrote after the subsidies for new plants were announced. “We need to reduce demand on the grid by making buildings more energy efficient, and we need to invest more in local and distributed energy systems like rooftop solar and battery storage. Our climate has changed, no matter how much fossil fuel-funded Texas politicians deny it.”

Bitcoin

What to watch for in the markets

Photo: Andrew Harnik (Getty Images)

After witnessing one of the largest global IT outages on record, affecting the travel, finance and healthcare sectors worldwideThis week is set to see more political drama, events, and earnings reports from tech giants.

Donald Trump’s ‘Lovefest’ Sets Jamie Dimon Up for Consideration for Treasury Secretary Job

Let’s take a look at what awaits us:

Major companies will release their earnings reports

Major tech companies and others will release their earnings reports this week, paving the way for what the second half of 2024 will look like.

Monday

- Verizon will report earnings before the start of operations.

Tuesday

- Coca-Cola, Comcast and UPS are all set to report earnings before the market opens.

- Tesla will report earnings in the morning, while General Motors will report earnings in the evening.

- Alphabet and Visa will report results after the market closes.

Wednesday

- AT&T will release its report before the market opens.

- Ford and Chipotle will report earnings after the market closes.

Thursday

- Earnings reports from AstraZeneca, American Airlines and Southwest Airlines will be released before the market opens.

Trump to speak at Bitcoin conference

Presumptive Republican presidential nominee Donald Trump will speak at the next Bitcoin Conference in Nashville, Tennesseewhich is scheduled for July 25-27. While this is the first time a presidential candidate will attend the conference, it has sparked a debate over whether the crypto-friendly Trump will receive support from the crypto community in the upcoming election.

In addition to Trump, independent presidential candidate Robert F. Kennedy Jr. will also discuss crypto during the conference. Crypto advocates such as ARK Investment’s Cathie Wood, MicroStrategy’s Michael Saylor, and whistleblower Edward Snowden are among some prominent names who will be participating in the conference.

Ether ETFs are on the way

New Ether Spot ETFs are set to begin trading on Tuesday, July 23. Much like the spot Bitcoin ETFs, these ETFs will allow investors to buy the second most popular cryptocurrency like stocks. BlackRock, Ark Invest/21Shares, VanEck, Grayscale, Fidelity, Bitwise, Franklin Templeton, and Invesco/Galaxy Digital are all set to offer Ether ETFs. Crypto asset manager Bitwise predict that trading in the Ether ETF will drive the price of Ether higher, potentially surpassing $5,000.

Bitcoin

Cryptocurrency’s Biggest Winners and Losers in a Second Trump Presidency

Bitcoin miners and cryptocurrency companies that have been blocked from going public in the U.S. could ultimately be the biggest winners in the digital asset world under a second Donald Trump presidency. Foreign companies at risk of losing market share could end up being the biggest losers.

That’s the view that’s taking hold among market participants and observers in the wake of the former president’s growing embrace of cryptocurrency as his chances of election grow. survey released Thursday by CBS News showed Trump with the majority — 52 percent — of likely voters in his likely November rematch with President Joe Biden.

Bitcoin

Bitcoin, Ethereum, Solana and Cryptocurrency Markets Look Ready to ‘Send’ as Stars Align, According to Investor Chris Burniske

Cryptocurrency investor Chris Burniske says Bitcoin (BTC), Ethereum (ETH), Solana (SUN) and the cryptocurrency market in general seem poised for a run.

Former Head of Cryptocurrency at ARK Invest account his 292,200 followers on social media platform X that several catalysts are aligning, suggesting that digital asset markets are on the verge of a bull run.

According to Burniske, a partner at venture capital firm Placeholder, the highly anticipated launch of Ethereum-based exchange-traded funds (ETFs), Republican presidential candidate Donald Trump speaking at an upcoming Bitcoin event, and the current state of the BTC, ETH, and SOL charts all suggest significant optimism for the cryptocurrency markets.

“With ETH ETFs set to go live, Trump speaking at The Bitcoin Conference, and BTC, ETH, and SOL charts looking [they do] (while stocks are weak), it’s hard to imagine a world where we don’t ship next week.”

Reuters recently reported that preliminary approval for ETH ETFs has been granted as the Bitcoin Conference is scheduled to take place from July 25-27.

BTC, ETH, and SOL are trading at $67,333, $3,528, and $174 at the time of writing, respectively.

The venture capitalist too provides an update on his prediction that the total crypto market cap will eventually hit $10 trillion. According to his chart, the path to $10 trillion is currently “23%” complete, as it sits around $2.2 trillion.

Source: Chris BurniskeX

Earlier this month, Burniske he said in an interview with Real Vision CEO Raoul Paul that he has his eye on the Move ecosystem, which was originally built by social media giant Meta and then used to develop layer 1 blockchains Sui (IUE) and Apts (APT).

Don’t miss a beat – Subscribe to receive email alerts directly to your inbox

To check Price action

Follow us on X, Facebook It is Telegram

Surf Hodl’s Daily Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be aware that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: DALLE3

Bitcoin

Here’s the next target for BTC before bulls can hold out for $70K

Bitcoin’s recovery is going well, and the market is seemingly poised to create a new all-time high in the near term.

Technical analysis

Per NegotiationRage

The daily chart

As the daily chart shows, the price of Bitcoin has been rising since it broke above the 200-day moving average.

The market has also reclaimed the $60K and $65K levels and is moving towards the $68K resistance zone, which could be the last hurdle before creating a new all-time high. With the RSI also indicating that the price has clear bullish momentum, it could be just a matter of time.

The 4-hour chart

Looking at the 4-hour chart, it is evident that the price has been rising rapidly since breaking the downtrend line to the upside. The market also broke the $65K resistance level with momentum, turning it into a support.

While almost everything points to a new record high in the coming weeks, there is one worrying sign. The RSI is showing a clear bearish divergence between recent price highs, which could indicate a correction or even a reversal in the near term.

Source: TradingView SPECIAL OFFER (Sponsored)

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive an exclusive $600 welcome offer on Binance (Full details).

LIMITED OFFER 2024 on BYDFi Exchange: Welcome Reward Up to $2,888, use this link to register and open a 100 USDT-M position for free!

Disclaimer: The information found on CryptoPotato is that of the writers quoted. It does not represent the opinions of CryptoPotato about buying, selling, or holding any investments. It is advised that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

Cryptocurrency Charts by TradingView.

-

Nfts12 months ago

Nfts12 months agoShardLab Launches ZK-Based Tool for Digital Identity and NFT Vouchers

-

News1 year ago

News1 year agoWallet recovery firms are abuzz as stranded cryptocurrency investors panic in the bitcoin boom

-

Bitcoin11 months ago

Bitcoin11 months agoBitcoin, Ethereum, Solana and Cryptocurrency Markets Look Ready to ‘Send’ as Stars Align, According to Investor Chris Burniske

-

Altcoins11 months ago

Altcoins11 months agoThree Altcoins Poised for Significant Growth in 2024: ETFS, OP, BLAST

-

Altcoins11 months ago

Altcoins11 months agoAccumulate these altcoins now for maximum gains

-

Nfts11 months ago

Nfts11 months agoOG Crypto Artist Trevor Jones Unveils Groundbreaking Collection of Ordinals | NFT CULTURE | NFT News | Web3 Culture

-

Bitcoin11 months ago

Bitcoin11 months agoBillionaires are selling Nvidia stock and buying an index fund that could rise as much as 5,655%, according to some Wall Street analysts

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!

-

Videos1 year ago

Videos1 year agoSTOCK MARKET FUD! ⚠️ [Why This Is GREAT For Bitcoin Traders!]

-

Videos1 year ago

Videos1 year agoAttention: a historically significant BITCOIN signal has just appeared!

-

News1 year ago

News1 year agoA Guide for Newcomers & Beginners – Forbes Advisor

-

Altcoins12 months ago

Altcoins12 months agoXRP, Shiba Inu, Cardano, Solana mega bounce imminent as Altcoin bottom remains strong ⋆ ZyCrypto