Bitcoin

Bitcoin commencement speaker defends ayahuasca-fueled speech, praises Satoshi

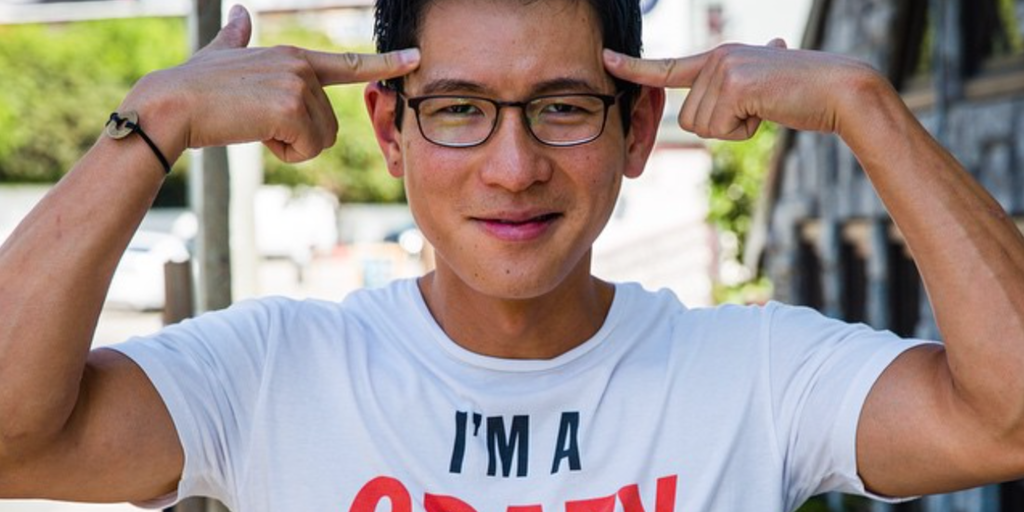

Ohio State University’s viral commencement speaker isn’t backing down despite the negative attention he’s received now famous speech received: Christopher Pan believes in the potential of Bitcoin, he told Decrypt in an interview. And he thinks you should too.

Why? Pan says that when his interest in Bitcoin was reignited earlier this year, it was dominated by one important trend: The institutions are here.

BlackRock and Fidelity piqued Pan’s interest in February as familiar Wall Street names delved deeper into the esoteric market through spot Bitcoin ETFs, he said. Decrypt. The development encouraged him to buy Bitcoin and he later included mention of it in his graduation speech.

“I’m an MBA from Harvard and a former Facebook employee, so I understand the adoption curves,” said Pan. “Suddenly, I understood: Wow, we’re ready to go mainstream. […] This is Bitcoin IPO time.”

Graduating from OSU in 1999, Pan’s unorthodox commencement speech attracted a lot of attention this week – not only for his suggestion to consider investing in Bitcoin, but also for his musical numbers, magic tricks and ayahuasca-fueled origins. His controversial comments included calling Bitcoin “a very misunderstood asset class,” which drew groans from the public.

Pan himself said he understood little about Bitcoin when he first heard about the asset in 2017. After buying a small amount in 2020, he sold his BTC after a 20% drop, he said.

“So embarrassing,” Pan recalled, adding that a steep drop “scared [him] outside.”

For years, crypto cognoscenti have considered financial institutions as powerful players to watch. Not only yours increasing involvement legitimize the digital asset space, but this year, asset managers’ products have been a main driver of Bitcoin’s year-to-date rally. From Pan’s point of view, this justified an allocation of more than just “virtual money” as before.

“ETFs, for me, offered convenience and a sense of security,” he said, highlighting that he doesn’t have to worry about managing the private keys of a digital wallet with the product. “That was a sign that the asset class had matured enough for me to really take it seriously.”

Before sharing his Bitcoin knowledge with 60,000 Ohio State commencement attendees on Sunday, Pan said he honed his comments in conversations with family and friends. Four weeks after rediscovering Bitcoin, this involved talking to his brother, father, cousins and friends. He didn’t want them to lose Bitcoin and believed the asset could help them financially.

Only in mid-March did Pan decide to include Bitcoin in his speech, he said. While emotional and spiritual health was always something he planned to address, he decided that Bitcoin could be an example of why it is beneficial to have an open mind.

“I was like, ‘You know what? Let me play [it] inside,” he said of Bitcoin’s inclusion. “It was just about financial health, of which Bitcoin was my example of something interesting to look at.”

A social entrepreneur, musician and inspirational speaker, one of Pan’s current ventures involves a positive affirmation jewelry business called My intention. In LinkedIn comments, responding to a post centered on psychedelics, several alleged participants he said his speech on Sunday seemed like promoting his business or agenda.

“All I said was: To be a great investor, you have to be open-minded and look for misunderstood opportunities,” he said. “Unfortunately, people just jump to conclusions.”

Still, Pan believes Bitcoin could solve real-world problems, like solving the U.S. housing shortage, by providing homeowners with an alternative store of value.

Drawing on his experience at management consulting firm McKinsey & Company, Pan said he gathered this new understanding of Bitcoin primarily through “YouTube University.”

This included watching videos of Twitter founder and Block CEO Jack Dorsey talking about Bitcoin, as well as MicroStrategy executive founder and chairman Michael Saylor. One of Dorsey’s conversations left a notable impression on Pan, he said, as it suggested that Bitcoin’s pseudonymous creator, Satoshi Nakatomo, was somewhat charitable.

“Here’s a trillion-dollar asset class where the founder disappeared after three years and didn’t want to come back and take credit for it,” said Pan. “I thought that was the coolest example of altruism. And I think that’s the most misunderstood part of Bitcoin.”

Edited by Andrew Hayward

Bitcoin

What to watch for in the markets

Photo: Andrew Harnik (Getty Images)

After witnessing one of the largest global IT outages on record, affecting the travel, finance and healthcare sectors worldwideThis week is set to see more political drama, events, and earnings reports from tech giants.

Donald Trump’s ‘Lovefest’ Sets Jamie Dimon Up for Consideration for Treasury Secretary Job

Let’s take a look at what awaits us:

Major companies will release their earnings reports

Major tech companies and others will release their earnings reports this week, paving the way for what the second half of 2024 will look like.

Monday

- Verizon will report earnings before the start of operations.

Tuesday

- Coca-Cola, Comcast and UPS are all set to report earnings before the market opens.

- Tesla will report earnings in the morning, while General Motors will report earnings in the evening.

- Alphabet and Visa will report results after the market closes.

Wednesday

- AT&T will release its report before the market opens.

- Ford and Chipotle will report earnings after the market closes.

Thursday

- Earnings reports from AstraZeneca, American Airlines and Southwest Airlines will be released before the market opens.

Trump to speak at Bitcoin conference

Presumptive Republican presidential nominee Donald Trump will speak at the next Bitcoin Conference in Nashville, Tennesseewhich is scheduled for July 25-27. While this is the first time a presidential candidate will attend the conference, it has sparked a debate over whether the crypto-friendly Trump will receive support from the crypto community in the upcoming election.

In addition to Trump, independent presidential candidate Robert F. Kennedy Jr. will also discuss crypto during the conference. Crypto advocates such as ARK Investment’s Cathie Wood, MicroStrategy’s Michael Saylor, and whistleblower Edward Snowden are among some prominent names who will be participating in the conference.

Ether ETFs are on the way

New Ether Spot ETFs are set to begin trading on Tuesday, July 23. Much like the spot Bitcoin ETFs, these ETFs will allow investors to buy the second most popular cryptocurrency like stocks. BlackRock, Ark Invest/21Shares, VanEck, Grayscale, Fidelity, Bitwise, Franklin Templeton, and Invesco/Galaxy Digital are all set to offer Ether ETFs. Crypto asset manager Bitwise predict that trading in the Ether ETF will drive the price of Ether higher, potentially surpassing $5,000.

Bitcoin

Cryptocurrency’s Biggest Winners and Losers in a Second Trump Presidency

Bitcoin miners and cryptocurrency companies that have been blocked from going public in the U.S. could ultimately be the biggest winners in the digital asset world under a second Donald Trump presidency. Foreign companies at risk of losing market share could end up being the biggest losers.

That’s the view that’s taking hold among market participants and observers in the wake of the former president’s growing embrace of cryptocurrency as his chances of election grow. survey released Thursday by CBS News showed Trump with the majority — 52 percent — of likely voters in his likely November rematch with President Joe Biden.

Bitcoin

Bitcoin, Ethereum, Solana and Cryptocurrency Markets Look Ready to ‘Send’ as Stars Align, According to Investor Chris Burniske

Cryptocurrency investor Chris Burniske says Bitcoin (BTC), Ethereum (ETH), Solana (SUN) and the cryptocurrency market in general seem poised for a run.

Former Head of Cryptocurrency at ARK Invest account his 292,200 followers on social media platform X that several catalysts are aligning, suggesting that digital asset markets are on the verge of a bull run.

According to Burniske, a partner at venture capital firm Placeholder, the highly anticipated launch of Ethereum-based exchange-traded funds (ETFs), Republican presidential candidate Donald Trump speaking at an upcoming Bitcoin event, and the current state of the BTC, ETH, and SOL charts all suggest significant optimism for the cryptocurrency markets.

“With ETH ETFs set to go live, Trump speaking at The Bitcoin Conference, and BTC, ETH, and SOL charts looking [they do] (while stocks are weak), it’s hard to imagine a world where we don’t ship next week.”

Reuters recently reported that preliminary approval for ETH ETFs has been granted as the Bitcoin Conference is scheduled to take place from July 25-27.

BTC, ETH, and SOL are trading at $67,333, $3,528, and $174 at the time of writing, respectively.

The venture capitalist too provides an update on his prediction that the total crypto market cap will eventually hit $10 trillion. According to his chart, the path to $10 trillion is currently “23%” complete, as it sits around $2.2 trillion.

Source: Chris BurniskeX

Earlier this month, Burniske he said in an interview with Real Vision CEO Raoul Paul that he has his eye on the Move ecosystem, which was originally built by social media giant Meta and then used to develop layer 1 blockchains Sui (IUE) and Apts (APT).

Don’t miss a beat – Subscribe to receive email alerts directly to your inbox

To check Price action

Follow us on X, Facebook It is Telegram

Surf Hodl’s Daily Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be aware that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: DALLE3

Bitcoin

Here’s the next target for BTC before bulls can hold out for $70K

Bitcoin’s recovery is going well, and the market is seemingly poised to create a new all-time high in the near term.

Technical analysis

Per NegotiationRage

The daily chart

As the daily chart shows, the price of Bitcoin has been rising since it broke above the 200-day moving average.

The market has also reclaimed the $60K and $65K levels and is moving towards the $68K resistance zone, which could be the last hurdle before creating a new all-time high. With the RSI also indicating that the price has clear bullish momentum, it could be just a matter of time.

The 4-hour chart

Looking at the 4-hour chart, it is evident that the price has been rising rapidly since breaking the downtrend line to the upside. The market also broke the $65K resistance level with momentum, turning it into a support.

While almost everything points to a new record high in the coming weeks, there is one worrying sign. The RSI is showing a clear bearish divergence between recent price highs, which could indicate a correction or even a reversal in the near term.

Source: TradingView SPECIAL OFFER (Sponsored)

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive an exclusive $600 welcome offer on Binance (Full details).

LIMITED OFFER 2024 on BYDFi Exchange: Welcome Reward Up to $2,888, use this link to register and open a 100 USDT-M position for free!

Disclaimer: The information found on CryptoPotato is that of the writers quoted. It does not represent the opinions of CryptoPotato about buying, selling, or holding any investments. It is advised that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

Cryptocurrency Charts by TradingView.

-

Nfts1 year ago

Nfts1 year agoShardLab Launches ZK-Based Tool for Digital Identity and NFT Vouchers

-

News1 year ago

News1 year agoWallet recovery firms are abuzz as stranded cryptocurrency investors panic in the bitcoin boom

-

Bitcoin1 year ago

Bitcoin1 year agoBitcoin, Ethereum, Solana and Cryptocurrency Markets Look Ready to ‘Send’ as Stars Align, According to Investor Chris Burniske

-

Altcoins1 year ago

Altcoins1 year agoThree Altcoins Poised for Significant Growth in 2024: ETFS, OP, BLAST

-

Altcoins1 year ago

Altcoins1 year agoAccumulate these altcoins now for maximum gains

-

Nfts1 year ago

Nfts1 year agoOG Crypto Artist Trevor Jones Unveils Groundbreaking Collection of Ordinals | NFT CULTURE | NFT News | Web3 Culture

-

Bitcoin1 year ago

Bitcoin1 year agoBillionaires are selling Nvidia stock and buying an index fund that could rise as much as 5,655%, according to some Wall Street analysts

-

Videos9 months ago

Videos9 months agoKamala just won the boner! [Bad For Crypto]

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!

-

News1 year ago

News1 year agoA Guide for Newcomers & Beginners – Forbes Advisor

-

Videos1 year ago

Videos1 year agoAttention: a historically significant BITCOIN signal has just appeared!

-

Videos1 year ago

Videos1 year agoSTOCK MARKET FUD! ⚠️ [Why This Is GREAT For Bitcoin Traders!]