Nfts

Are NFTs dead or just taking a break? Analyze the current state of the NFT market

A substantial slowdown has affected the NFT sector, causing its sales and price to drop.

TL;DR:

- The NFT market has seen a significant slowdown, marked by a drop in sales and prices.

- Factors contributing to this decline include speculative investments, scams and fraud, market oversaturation and regulatory oversight.

- Despite the economic slowdown, signs of resurgence have emerged recently, with increasing trade volumes and the emergence of new markets.

- The future of NFTs remains bright, with potential applications in digital identity verification, supply chain management, DeFi, virtual real estate, intellectual property rights, gaming and manufacturing music and entertainment.

- NFTs are not dead, but rather evolving, and their long-term trajectory is still uncertain. Investors should exercise caution and conduct thorough research.

NFTs at the crossroads

The meteoric rise of Non-fungible tokens (NFTs) Their origin dates back to their introduction in 2014. Since then, they have captured the imagination of artists, collectors and investors.

Yet this new craze around NFTs has not come without its share of controversy.

In recent months, the NFT sector has seen a significant slowdown, marked by a drop in sales and prices of items. What was once a booming market, with huge amounts of money spent on popular NFT collectible projects, appears to have lost momentum.

Brands that rushed into the NFT market are now re-evaluating their short-term goals. While cryptocurrency market sentiment remains bearish, the NFT landscape appears to be at a crossroads.

In this article, we’ll take a deep dive into the current state of NFTs, analyzing the factors that have contributed to the market slowdown. We’ll explore the arguments for and against NFTs, examining potential growth opportunities and challenges ahead. Ultimately, we’ll attempt to answer the burning question: are NFTs dead or just suffering a temporary setback?

The hype and initial success

The concept of NFTs has gained traction to bring scarcity and value to the digital world.

The NFT market saw a wave of high-profile sales that attracted global attention in the second half of 2021. Notably, Beeple’s digital artwork, titled “Every day: the first 5,000 dayswas sold for a staggering $69 million, propelling NFTs to the forefront. This unprecedented sale highlighted the potential for digital art to acquire significant value in the marketplace.

Another notable example is Pak’s “The Fungible” collection, featuring the iconic “Clock” piece, which sold for $52 million. These high-profile sales have cemented NFTs’ position as a lucrative investment opportunity.

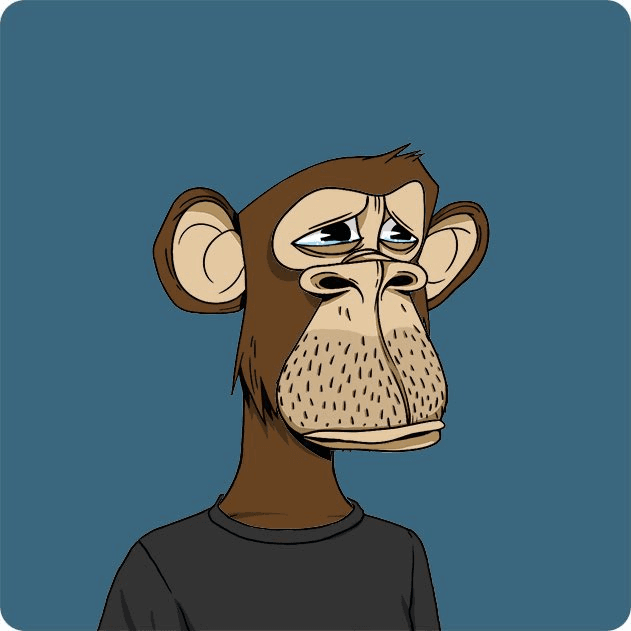

Additionally, the role of celebrities and influencers in promoting NFTs Celebrities and influencers played a vital role in the initial craze and popularity of NFTs. High-profile figures like Eminem and Jimmy Fallon have openly supported NFT projects like Bored Ape Yacht Club (BAYC), generating considerable attention.

During the same period, the rise of NFT markets, such as OpenSea and Rarible, have made it easier to buy and sell NFTs, fueling interest and participation from seasoned collectors and newcomers alike. The NFT space has garnered so much attention that NFT volume on OpenSea surpassed $184 million in one day, with over 43,000 active users.

OpenSea statistics over one year (Source)

At the height of the NFT frenzy, with record sales and celebrity support, NFTs were on an inevitable trajectory. Nonetheless, as we explore the following sections, we will uncover the challenges and controversies that have emerged, raising questions about the long-term sustainability of NFTs.

The Rise and Fall of NFTs: Understanding the Reasons for the Decline

Eventually, the euphoria subsided, leading to a significant decline in the NFT market.

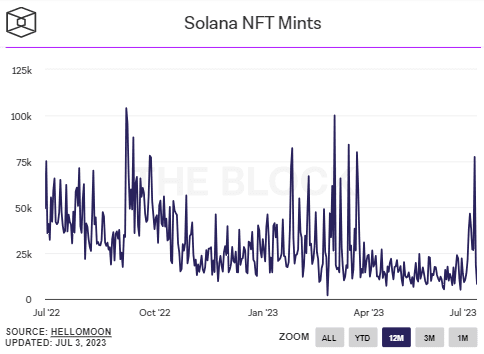

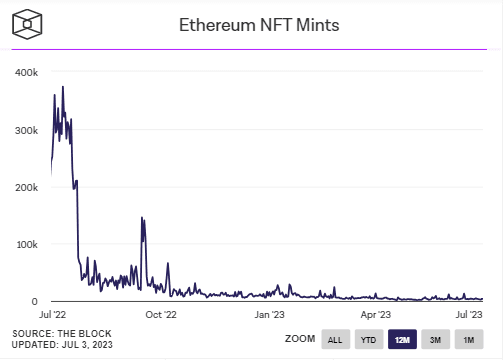

The number of Ethereum NFTs created has dropped from 373,000 on July 10, 2022 to 3,590,000 on July 1, 2023.Source)

The number of Ethereum NFTs created has dropped from 373,000 on July 10, 2022 to 3,590,000 on July 1, 2023.Source)

Beyond broader market dynamics, unique challenges and issues have played a role in the fall of NFTs:

1. The role of speculators and inflated prices:Some argue that the skyrocketing valuations of some NFTs have been fueled by speculative investors rather than any real appreciation of the underlying art or digital assets. Additionally, the volatility and uncertainty surrounding NFT prices have contributed to instability and risk within the market.

2. Increase in scams and frauds in the NFT market:With the exponential growth of the NFT industry, many small projects have emerged, some of which have been revealed to be scams. Investors and collectors have fallen victim to “rug pulls,” where creators abruptly exit scams, leaving participants with worthless or nonexistent NFTs. These incidents have fueled a sense of distrust within the community, leading to broader skepticism about the legitimacy and trustworthiness of NFT projects.

3. Market correction factors including oversaturation Oversaturation played a crucial role in the NFT market correction. At the height of the NFT hype, numerous projects emerged, flooding the market with an abundance of digital assets. This saturation made it difficult for investors and collectors to distinguish between high-quality NFTs and those of lesser value.

4. Regulatory control of NFT platforms and transactions: Governments around the world are grappling with how to regulate these digital assets, and new laws and regulations could impact NFT platforms and transactions. The prospect of increased regulation has created a sense of caution among investors, further contributing to the market correction.

Due to all these factors, the NFT market has experienced a significant slowdown, marked by a drop in both sales and prices. To give you an idea, in January 2022, Justin Bieber purchased this Bored Ape NFT for $1.31 million. Currently, it is worth less than $59,000.

Total trading volume in the NFT market fell from $10.7 billion in Q4 2022 to $4.7 billion in Q1 2023, a staggering 53% drop, according to a report. DappRadar Report.

Are NFTs Dead?

By looking at the current state of the NFT market and comparing it to historical performance, we can determine whether NFTs are dead or still thriving.

After experiencing a decline in trading volume for several months, a notable reversal occurred in January, with a 38.5% increase over the previous month. This trend continued in February, with trading volume reaching a staggering $2 billion, an increase of 111% over the previous month. This increase in trading volume was largely driven by the emergence of Blur, a new marketplace that has quickly gained momentum within the NFT ecosystem, and the emergence of NFT BRC-20.

Interestingly, despite a decrease in the number of sales from 9.2 million in January to 6.3 million in February, the average sale price of NFTs increased to accommodate the substantial increase in trading volume.

Despite the high cost of transactions and scalability challenges, Ethereum accounted for $1.8 billion in transaction volume in February, demonstrating its continued dominance. On the other hand, Solana accounted for $75 million in trading volume during the same period, indicating its growing popularity as a viable NFT chain. The number of NFT coins on Solana has also remained relatively stable.

Despite February’s impressive surge, it is a far cry from the record month of January 2022, when over $5.5 billion worth of NFTs were traded on major exchanges. Nonetheless, the recent resurgence in trading volume and the presence of new markets demonstrate that there is still life and growth potential in the NFT market.

The future of NFTs

While the NFT market is experiencing a correction and moving away from its initial speculative hype, the future of NFTs remains bright. Additionally, advancements in blockchain technology, such as Ethereum’s Layer 2 solutions, are improving the accessibility of NFTs by reducing environmental impact and transaction costs.

Looking ahead, the unique utility of NFTs for establishing ownership and authenticity in the digital world presents countless innovative applications across all industries. Here are some potential uses:

Digital Identity Verification: NFTs could be used to represent digital identities, improving the security and reliability of online interactions. This technology has the potential to prevent fraud and secure digital transactions.

Supply Chain Management: By attaching NFTs to products, consumers can verify their authenticity and trace their origin and journey throughout the supply chain, promoting transparency and trust.

Decentralized Finance (DeFi): NFTs can be used as collateral for loans or to represent shares in investments, expanding the possibilities of DeFi.

Virtual Real Estate and Metaverse: As the concept of the metaverse grows, NFTs will increasingly be used to own and trade land, buildings, and other virtual assets in virtual worlds like Decentraland and Cryptovoxels.

Intellectual Property Rights: NFTs could change the way intellectual property is bought, sold, and managed by representing ownership of patents, trademarks, and copyrights.

Games : NFTs allow players to own and trade in-game assets independently of game developers, thereby monetizing their virtual skills.

Music and entertainment industry: Artists and creators can leverage NFTs to directly sell exclusive music, videos, or experiences to fans, allowing for greater control and direct interaction with their audience.

NFT: Not Dead, But Evolving

The potential for NFTs to become more popular in the future is significant. Factors such as infrastructure development, NFT scarcity, diversification opportunities, growing adoption across industries, and growing acceptance by artists and mainstream brands all contribute to the potential for the NFT market to recover and thrive.

The recent increase in trading volume and continued interest in NFTs demonstrate that there is still value and potential in this digital asset class. However, it is important to note that the market continues to evolve and its future trajectory remains uncertain. Investors should exercise caution, conduct thorough research, and understand the dynamics of the NFT market before engaging in any transaction.

In conclusion, even though NFTs have seen a decline, they are not dead. It will be interesting to see how the NFT landscape evolves and how this unique asset class continues to shape the digital economy.

Nfts

NFTs Maintain Upward Momentum, Sales Volume Surpasses $107 Million

Non-fungible tokens, or NFTs, saw sales volume surge for the second week in a row, reaching $107 million, an increase of 8.5%.

A substantial increase in the number of NFT Buyers accompanied this growth, reaching 488,141 — a staggering increase of 89.56%.

On the other hand, the number of NFT sellers also increased by 69.8%, totaling 198,450, signaling an improved business environment and increased market engagement.

Below is a look at what happened in the NFT market over the past week.

Ethereum Maintains Leading Position While Solana and Bitcoin Follow

Blockchains by weekly NFT sales volume | Source: CryptoSlam

Over the past few weeks, Ethereum (ETH) continued to dominate the NFT market with $36.6 million in total sales, driven by 35,236 buyers, a 46.31% increase from the previous week.

Solana (GROUND) has emerged as a serious competitor, recording total revenue of $26.15 million, thanks to a substantial 114.07% increase in the number of buyers.

Bitcoin (Bitcoin) The NFT market also saw a notable surge, with total sales reaching $21.4 million, thanks to a staggering 222.29% increase in buyers.

Polygon (MATICS), which had the second best performance the previous week, saw its total sales volume drop by more than 15%, dropping it to 4th place just ahead of Immutable (IMX).

Other notable performances were achieved by Zora and Blast, which recorded the two largest percentage increases in sales volume, at 463% and 227% respectively.

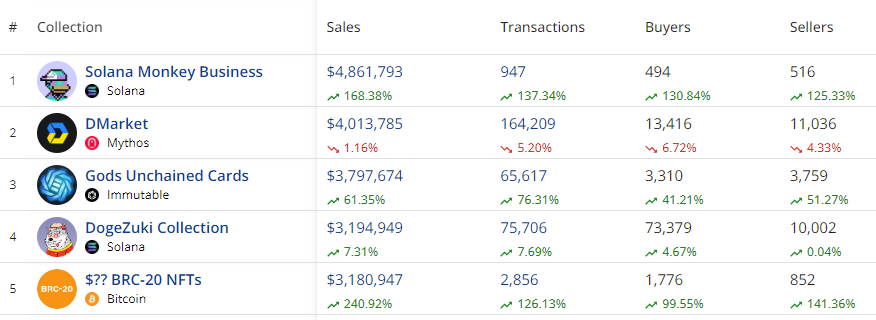

Best Collections: Solana Monkey Business Shines

Ranking NFT collections by weekly sales volume | Source: CryptoSlam

Ranking NFT collections by weekly sales volume | Source: CryptoSlam

Among the top NFT collections, Solana Monkey Business came out on top with $4.86 million in sales, an increase of 168.38%. The collection also saw a significant increase in transactions (137.34%) and buyers (130.84%).

The DMarket collection on the Mythos blockchain, which recorded $4.01 million in sales, came in a close second. Interestingly, this is the only collection among the top 5 by sales volume to see a decline in the number of transactions and buyers.

Immutable’s Gods Unchained cards also made headlines with $3.8 million in sales, an increase of 61.35%. This collection saw notable growth in both transactions (76.31%) and buyers (41.21%), a testament to the growing popularity of blockchain-based trading cards.

Best-Selling NFTs and Fan Tokens

In terms of individual sales, Ethereum’s Autoglyphs #167 led with a sale of $274,561, followed by Bitcoin’s Protoshrooms with $148,574. Other notable sales included BNB’s kNFT: Locked kUSDT and Arbitrum’s Umoja Synths, highlighting the diversity and breadth of the NFT market across different blockchains.

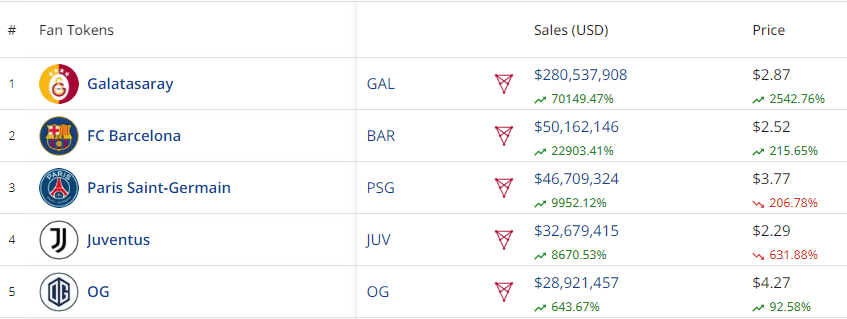

Top 5 Fan Tokens by Sales Volume

Top 5 Fan Tokens by Sales Volume

As can be seen in the table above CryptoSlamFan tokens also continued to see explosive growth, with Galatasaray’s token on the Chiliz blockchain recording a turnover of $280.5 million. This reflects an increase of 70149.47%.

FC Barcelona and Paris Saint-Germain followed with substantial sales volumes, indicating the growing popularity of sports-related NFTs.

Market consequences

The latest performance of the NFT market marks a significant turnaround, demonstrating resilience and renewed investor interest after a period of declining sales volumes.

This is the second consecutive week of improved sales, suggesting a potential upward trend. It is worth noting that this resurgence comes amid a broader recovery in the cryptocurrency market, which is currently valued at $2.55 trillion.

Major cryptocurrencies like Bitcoin, Ethereum, BNB, and Solana have all registered Prices have risen by double digits over the past week, further fueling optimism in the digital asset sector.

The correlation between rising cryptocurrency prices and the recovery of the NFT market could be an indication of strengthening investor confidence, setting a positive tone for the coming weeks.

Nfts

APENFT’s One-Day Trading Volume Hits $16.67 Million (NFT)

APENFT (NFT) fell 0.3% against the U.S. dollar in the 24-hour period ending at 9:00 a.m. ET on July 21. APENFT has a market cap of $8.54 million and $16.67 million worth of APENFT was traded on exchanges over the past day. Over the past week, APENFT has been trading 3.1% lower against the US Dollar. One APENFT token can now be purchased for around $0.0000 or 0.00000000 BTC on major cryptocurrency exchanges.

Here’s how other cryptocurrencies performed over the past day:

- KILT Protocol (KILT) is up 1.9% against the dollar and is now trading at $0.20 or 0.00000302 BTC.

- Aidi Finance (BSC) (AIDI) fell 2.2% against the dollar and is now trading at $0.0000 or 0.00000000 BTC.

- Zoo Token (ZOOT) fell 2.2% against the dollar and is now trading at $0.0652 or 0.00000239 BTC.

- CareCoin (CARES) fell 2.2% against the dollar and is now trading at $0.0809 or 0.00000297 BTC.

- Kitty Inu (KITTY) rose 1.9% against the dollar and is now trading at $95.84 or 0.00338062 BTC.

- Hokkaidu Inu (HOKK) rose 1.2% against the dollar and is now trading at $0.0004 or 0.00000001 BTC.

- Jeff in Space (JEFF) fell 2.2% against the dollar and is now trading at $2.75 or 0.00010076 BTC.

- Lumi Credits (LUMI) fell 0.7% against the dollar and is now trading at $0.0128 or 0.00000019 BTC.

- AXIA Coin (AXC) fell 0.1% against the dollar and is now trading at $13.43 or 0.00048094 BTC.

About APENFT

APENFT launched on March 28, 2021. The total supply of APENFT is 999,990,000,000,000 tokens and its circulating supply is 19,999,800,000,000 tokens. The official website of APENFT is apenft.orgThe official APENFT Twitter account is @apenftorg and his Facebook page is accessible here.

According to CryptoCompare, “APENFT is a blockchain-based platform created by the APENFT Foundation to create, buy, sell, and trade non-fungible tokens (NFTs) on the TRON and Ethereum networks. It allows for the ownership and trading of unique digital assets such as artwork, music, videos, and more. It also provides tools for artists and creators to create and promote their own NFTs, as well as participate in community events and governance.”

APENFT Token Trading

It is not currently generally possible to purchase alternative cryptocurrencies such as APENFT directly using US dollars. Investors wishing to acquire APENFT must first purchase Ethereum or Bitcoin using an exchange that deals in US dollars such as CoinbaseGDAX or Gemini. Investors can then use their newly acquired Ethereum or Bitcoin to purchase APENFT using any of the exchanges listed above.

Receive daily news and updates from APENFT – Enter your email address below to receive a concise daily summary of the latest news and updates for APENFT and associated cryptocurrencies with FREE CryptoBeat Newsletter from MarketBeat.com.

Nfts

Next US Vice President JD Vance Holds Bitcoin and NFTs, Expected to Boost MATIC and Algotech Post-Election

The blockchain technology landscape is about to transform as JD Vance, the likely next US vice president, emerges as a strong advocate for digital assets. Recent reports suggest that Vance not only holds Bitcoin (BTC) and NFTs, but is also willing to back promising blockchain initiatives like Polygon (MATIC) and Algotech (ALGT) post-elections.

JD Vance’s Cryptocurrency Investments Highlight Shift in Government Perspective

U.S. Senator JD Vance has garnered considerable attention for his recent investments in Bitcoin (BTC) and NFTs. Public records indicate that he owns between $100,000 and $250,000 worth of Bitcoin (BTC), indicating considerable interest in the success of the cryptocurrency market. This level of financial commitment from a high-profile government figure is unprecedented and underscores the growing credibility and promise of digital assets.

JD Vance’s interests extend beyond Bitcoin (BTC) to non-fungible tokens (NFTs), with reports suggesting his involvement in acquiring notable pieces from renowned collections. While the details of his NFT portfolio remain unknown, those who know the senator confirm his foray into this field.

This exploration of NFTs underscores Vance’s openness to exploring innovative and artistic applications of blockchain technology beyond cryptocurrencies’ typical role as assets or means of exchange. Vance’s involvement with cryptocurrency stands in stark contrast to the views of many of his peers in Congress, who often express doubt or hostility toward digital currency.

His direct involvement as an investor and user of these technologies gives him a unique perspective on their potential benefits and drawbacks. This practical understanding is likely to influence his stance on policy and regulation should he take on the role of vice president.

Polygon (MATIC) Hits $0.53, Eyes Breakout Amid Market Slowdown

The Vance administration, known for its support for cryptocurrencies, could significantly boost Polygon (MATIC), a major Ethereum layer 2 scaling project. MATIC has already attracted the attention of the developer community for its innovative solutions.

Even so, regulatory uncertainties have slowed widespread adoption and integration with traditional financial systems. Vance’s backing could serve as a driving force to unlock Polygon’s untapped capabilities.

A recent look at the MATIC token shows that its current trading value is $0.53, which represents an increase of over 2% in the last 24 hours. This surge coincides with a downturn in the broader cryptocurrency market, signaling solid fundamental strength and a growing sense of confidence among investors regarding Polygon’s future prospects.

Based on technical indicators, MATIC appears to be facing a resistance level that has persisted for several months, hinting at a potential breakout that could propel prices towards the previous peak around $1.29.

MATIC’s cutting-edge technology has taken a significant leap forward with the introduction of the Plonky3 zero-knowledge proof system. This innovation in zk-rollup technology is set to revolutionize MATIC’s scalability and efficiency, cementing its position as the premier choice for developers and enterprises.

Algotech (ALGT) Eyes $1 Price Hike When Its Exchange Launches

Algotech, a project that has attracted the interest of crypto enthusiasts and JD Vance, aims to transform algorithmic trading in the cryptocurrency space. Through the use of artificial intelligence and machine learning, Algotech offers advanced trading strategies to ordinary investors.

The platform’s innovative approach and ambitious roadmap are in line with JD Vance’s goal of driving financial innovation and making sophisticated investment tools more accessible to all. Algotech’s decentralized structure stands out, aligning perfectly with the core principles of blockchain technology.

By cutting out the middleman and giving users direct authority over their trading algorithms, Algotech embodies the essence of financial independence advocated by many in the crypto community, including Vance. This common ground makes Algotech a natural choice for endorsement by crypto-friendly leadership.

As Algotech’s pre-sale gains momentum, with over $9.6 million in funding, excitement is building for its official launch. Analysts have set lofty price targets, with some even suggesting that ALGT could surge to $1 shortly after it goes public.

While it’s wise to approach these predictions with caution, the combination of Algotech’s cutting-edge technology and the potential backing of key figures like JD Vance could pave the way for significant growth and adoption.

Learn more:

Disclaimer: This is a paid release. The statements, views, and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of Bitcoinist. Bitcoinist does not guarantee the accuracy or timeliness of any information available in this content. Do your research and invest at your own risk.

Nfts

OG Crypto Artist Trevor Jones Unveils Groundbreaking Collection of Ordinals | NFT CULTURE | NFT News | Web3 Culture

Trevor Jones’ New Genesis BTC Collection: CryptoAngels

Known for his innovative blend of physical and digital art, Trevor Jones continues to push the boundaries of the NFT space with his latest collection, CryptoAngels. Since his foray into Bitcoin-themed artwork in 2017, Jones has garnered a significant following, cementing his reputation with record-breaking sales and community events.

The Bitcoin Angel Journey

In 2021, Jones made headlines with his Bitcoin Angel open edition, selling 4,158 editions for an incredible $3.2 million in just seven minutes. This success paved the way for his latest venture, where he combines art, community, and technology in new ways. His annual Castle Parties, celebrating art, culture, and charity, have further cemented his place in the Web3 world.

CryptoAngels Collection Review

Jones’ CryptoAngels collection is divided into two main stages: Archangels and CryptoAngels.

- Step 1: The Archangels The initial phase, Archangels, saw 21 collector’s packages sold for 87.9 ETH (approximately $335,291). Each package included:

- A physical bronze sculpture of the Bitcoin angel

- A 3D NFT avatar

- An Archangel Ordinal

Esteemed collectors like ModeratsArt, Batsoupyum, Bharat Krymo, Blondie23LMD, and 1Confirmation now lead the CryptoAngel army as Archangel Collectors.

- Step 2: CryptoAngels The second phase, set to launch on August 7, features 7,777 unique CryptoAngels. These will be available for minting via OrdinalsBot, starting with a whitelisting phase. Each CryptoAngel is distinct and named by Jones himself. The collection is organized into 21 cohorts, each associated with one of Archangel’s collectors, fostering sub-communities within the larger collection. Additionally, there are seven 1/1 CryptoAngels, making them exceptionally rare and not aligned with a cohort.

Connecting Bitcoin and Art

Jones, who has been a strong Bitcoin supporter since mid-2017, expresses his deep connection to the crypto community. He sees the CryptoAngels collection as a tribute to that community, bringing his iconic Bitcoin Angel motif to the blockchain.

“I have been personally investing in Bitcoin since mid-2017 and its ethos quickly inspired me in my crypto art journey. I have followed the growth of Ordinals since its inception and the CryptoAngels collection is my offering to a community that has welcomed me with open arms and given me the opportunity to bring my Bitcoin Angel motif to the chain where it was always meant to be,” said artist Trevor Jones.

Collectors’ opinions

“Bitcoin’s OG artist Trevor Jones, behind the Bitcoin Angels depositing ordinals on the immutable chain is a match made in crypto-native art heaven.” – Bharat Krymo (@krybharat – Archangel Collector)

“The 2018 Bitcoin Angel oil painting is one of the first crypto tributes to Bitcoin, so CryptoAngels on Ordinals is a natural extension of Trevor’s artistic journey” – batsoupyum (Archangel Collector)

Interactive experience and limited editions

Rounding out the collection, 21 special Angels will be available to mint for $7 each on Base, playable in the exclusive retro arcade game, Dante’s Pixel Inferno. The game challenges players to guide their Angel through the nine circles of Fiat Hell, collecting Bitcoin and earning rewards. Each Angel in the game has unique abilities and weapons.

Whitelisting Opportunities and Community Engagement

Whitelisting (WL) opportunities are available through community partnerships, existing Bitcoin Angel OE and Trevor’s Ascended Angels holders, and weekly giveaways. To stay up to date and secure a spot on the whitelist, join Trevor Jones’ active Discord community.

TL;DR

Trevor Jones is launching the CryptoAngels collection on August 7th, building on his Bitcoin Angel legacy. Split into two stages, Archangels and CryptoAngels, the collection includes unique NFTs and physical artworks, fostering strong community connections. Exclusive gaming experiences and limited minting opportunities enhance engagement. Join the Discord for your chance to win.

-

Nfts1 year ago

Nfts1 year agoShardLab Launches ZK-Based Tool for Digital Identity and NFT Vouchers

-

News1 year ago

News1 year agoWallet recovery firms are abuzz as stranded cryptocurrency investors panic in the bitcoin boom

-

Bitcoin1 year ago

Bitcoin1 year agoBitcoin, Ethereum, Solana and Cryptocurrency Markets Look Ready to ‘Send’ as Stars Align, According to Investor Chris Burniske

-

Altcoins1 year ago

Altcoins1 year agoThree Altcoins Poised for Significant Growth in 2024: ETFS, OP, BLAST

-

Altcoins1 year ago

Altcoins1 year agoAccumulate these altcoins now for maximum gains

-

Nfts1 year ago

Nfts1 year agoOG Crypto Artist Trevor Jones Unveils Groundbreaking Collection of Ordinals | NFT CULTURE | NFT News | Web3 Culture

-

Bitcoin1 year ago

Bitcoin1 year agoBillionaires are selling Nvidia stock and buying an index fund that could rise as much as 5,655%, according to some Wall Street analysts

-

Videos9 months ago

Videos9 months agoKamala just won the boner! [Bad For Crypto]

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!

-

News1 year ago

News1 year agoA Guide for Newcomers & Beginners – Forbes Advisor

-

Videos1 year ago

Videos1 year agoAttention: a historically significant BITCOIN signal has just appeared!

-

Videos1 year ago

Videos1 year agoSTOCK MARKET FUD! ⚠️ [Why This Is GREAT For Bitcoin Traders!]