Bitcoin

How Kraken’s Index Assistant Is Outperforming Coinbase and Binance in the $58 Billion Bitcoin ETF Race – DL News

- Kraken’s 2019 acquisition of CF Benchmarks paid off in the Bitcoin ETF boom.

- BlackRock, Ark Invest and other Wall Street giants use the venture’s Bitcoin Reference Rate.

- Kraken is raking in licensing revenue as investors pour money into ETFs.

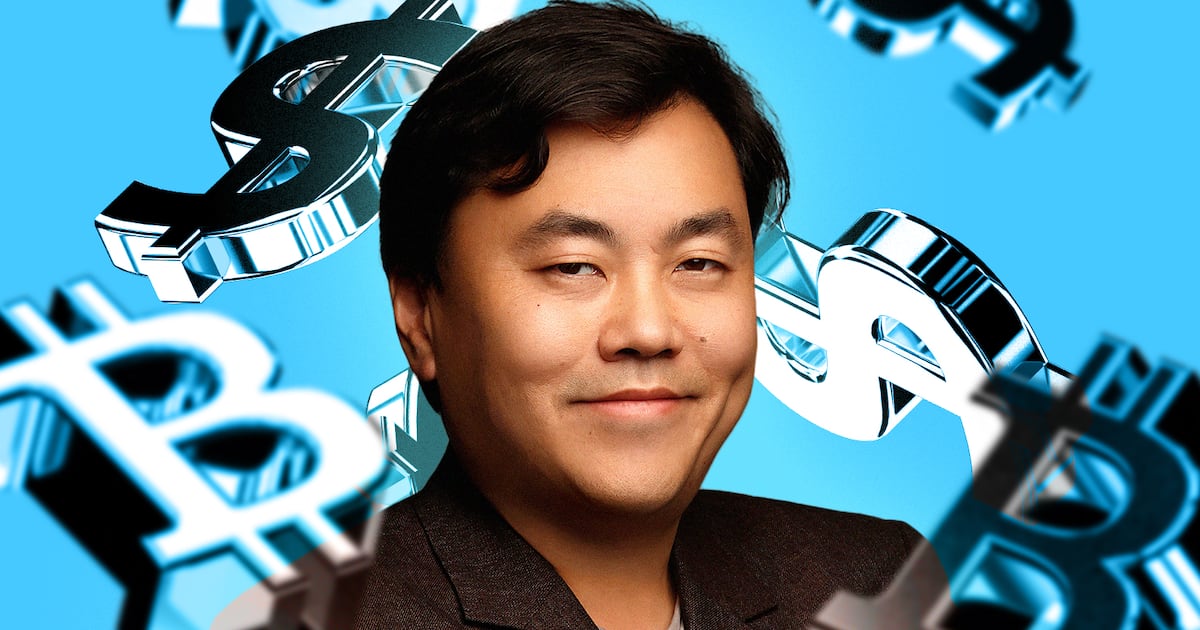

Sui Chung couldn’t believe what he was seeing.

It was late one night in February, and Chung, CEO of a financial company called CF Benchmarks, was looking at numbers on his laptop.

“I advanced my revenue forecast,” Chung said in an interview at a cafe in the London neighborhood of Soho. “By the time I finished all the math, it was 1am and I was like… damn.”

More than $1.4 billion has been invested in 11 new Bitcoin exchange-traded funds in recent weeks, according to data from Bitcoin Reference Rate, or BRR, an index produced by his firm.

Six of these funds issued by Wall Street giants BlackRock, Ark Invest and Franklin Templeton, among others, track the BRR index.

This meant Chung’s company was about to rake in a lot in licensing revenue.

Within a month, Bitcoin ETFs reached Chung’s one-year goal. And the Bitcoin ETF boom was just beginning.

Eye-watering recipe

The performance also demonstrated the prescience of Kraken, the San Francisco-based cryptocurrency exchange. In 2019, Kraken acquired CF Benchmarks for a nine-figure sum.

Join the community to receive our latest stories and updates

Now, investors have worked almost US$58 billion in Bitcoin ETFs – CF Benchmarks is on a cash cow as license fees accumulate.

Better yet, neither Binance nor Coinbase, Kraken’s archrivals in the crypto exchange space, have index businesses of their own.

And CF Benchmarks has deleted price data from Binance, the world’s largest and most liquid exchange, because it doesn’t meet its criteria.

While CF Benchmarks doesn’t disclose how much it’s earning, it’s poised to generate fees for some time.

S&P Dow Jones, for example, charges clients about 3 basis points, or 0.03%, on assets based on its S&P 500 indexes, according to a 2022 article.

Consider just one of these ETFs – the one State Street – is managing US$541 billion. That means S&P is collecting $162 million in fees from this fund.

In April, Hong Kong approved Bitcoin and Ethereum ETFs and the three issuers – Harvest Global Investments, China AM and Bosera AM – use BRR as a benchmark for their offerings.

US$40 trillion market

Without indices, there would be no ETFs. Companies like BlackRock’s iShares unit manufacture indices to support ETFs. And they monitor everything from stocks to bonds and commodities like gold and oil.

Benchmark indices such as the S&P 500 support a range of ETFs and have become constants in the $40 trillion retirement market.

Somewhere along the way, Chung realized there was an opportunity to create an index for Bitcoin.

With a background in benchmarking, Chung was immersed in the inner workings of the financial data that feeds capital markets.

In 2016, Crypto Facilities, a London-based cryptocurrency derivatives exchange, realized it needed an index to help settle cryptocurrency futures contracts at the right price.

It was also in talks to provide this index to CME, the derivatives trading giant in Chicago, for its upcoming Bitcoin futures product.

‘No plan’

Chung was hired to create the index with just four software developers, eventually creating a business under the Crypto Facilities umbrella in 2018.

At the time there were few Bitcoin indices, so Chung’s team was working “without a plan,” he said.

He thought they might be very similar to the indices from dominant providers S&P or MSCI. But there were important challenges.

Unlike stocks, crypto is a 24/7 market traded on a variety of global, unregulated exchanges.

S&P only needs to take a snapshot of the price of, say, Apple’s shares all at once and in one place—say, at the close of the day on the New York Stock Exchange.

“But with cryptography, you need to figure out what the price of Bitcoin is at a given time and what the key times of the day are when financial transactions are settled, and build a methodology around that,” Chung said.

“And you must do this in a way that is reliable and consistent with financial regulations for traditional products – even if it is this new asset class,” Chung said.

It was a big challenge. But Chung’s team had a powerful weapon: its relationship with CME.

CME’s Bitcoin futures contracts were among the first regulated products in crypto, and it has licensed BRR since launch at the end of 2017.

And then Kraken came calling.

Supported indexes

In 2019, the exchange bought Crypto Facilities and CF Benchmarks for an undisclosed amount. But it was Kraken’s biggest deal since its exchange went live in 2013.

“At CF Benchmarks, we recognize the central role that an authorized benchmark administrator would have to play” in Bitcoin ETFs, said Tim Ogilvie, head of Kraken Institutional. DL News.

“Fast forward to today, CF Benchmarks is now the largest crypto index provider in the world,” Ogilvie added. “They will play an important role in the proliferation of the crypto product space.”

Producing compatible indexes is not easy. Index providers must input prices from heavily regulated exchanges, such as the NYSE and Nasdaq, to ensure data integrity and reliability.

Regulators don’t want investors to buy ETFs based on flawed indexes.

![]()

But it is difficult for a crypto index provider to enter similar types of prices in a market where regulation and reliability remain patchy.

As a result, CF Benchmarks maintains rigorous selection criteria exchanges must comply to be considered for inclusion in the benchmark, Chung said.

For example, the exchange must prove that it prevents fraud and carries out rigorous know-your-customer processes and anti-money laundering checks.

No Binance

BRR aggregates price data from six constituent exchanges, including Kraken, Gemini, and Coinbase. Binance, however, is not taken advantage of due to its regulatory issues.

After the exchange paid a $4.3 billion fine and pleaded guilty to violating US banking law in November, Binance CEO Richard Teng is working to comply with regulations. But it has been a slow process.

Chung admitted that he did not have price data for an exchange that now has 200 million global users It’s a huge data gap.

However, it is more important that it is able to defend the integrity of the benchmark.

“If that means I have a smaller business, so be it,” Chung said.

New wave

Now, Kraken’s deal for CF Benchmarks has positioned it to profit from a new era in crypto – the advent of Bitcoin and Ethereum ETFs.

As they are affordable and easy to trade products, ETFs promise to open the cryptocurrency market to a new wave of investors.

Although the receipt of funds from Hong Kong was warm Compared to the US, analysts say the offers could raise a billion dollars between them.

Chung is now defining his views over South Korea, where authorities are discussing whether spot Bitcoin ETFs should be allowed.

Contact the author at joanna@dlnews.com

Bitcoin

What to watch for in the markets

Photo: Andrew Harnik (Getty Images)

After witnessing one of the largest global IT outages on record, affecting the travel, finance and healthcare sectors worldwideThis week is set to see more political drama, events, and earnings reports from tech giants.

Donald Trump’s ‘Lovefest’ Sets Jamie Dimon Up for Consideration for Treasury Secretary Job

Let’s take a look at what awaits us:

Major companies will release their earnings reports

Major tech companies and others will release their earnings reports this week, paving the way for what the second half of 2024 will look like.

Monday

- Verizon will report earnings before the start of operations.

Tuesday

- Coca-Cola, Comcast and UPS are all set to report earnings before the market opens.

- Tesla will report earnings in the morning, while General Motors will report earnings in the evening.

- Alphabet and Visa will report results after the market closes.

Wednesday

- AT&T will release its report before the market opens.

- Ford and Chipotle will report earnings after the market closes.

Thursday

- Earnings reports from AstraZeneca, American Airlines and Southwest Airlines will be released before the market opens.

Trump to speak at Bitcoin conference

Presumptive Republican presidential nominee Donald Trump will speak at the next Bitcoin Conference in Nashville, Tennesseewhich is scheduled for July 25-27. While this is the first time a presidential candidate will attend the conference, it has sparked a debate over whether the crypto-friendly Trump will receive support from the crypto community in the upcoming election.

In addition to Trump, independent presidential candidate Robert F. Kennedy Jr. will also discuss crypto during the conference. Crypto advocates such as ARK Investment’s Cathie Wood, MicroStrategy’s Michael Saylor, and whistleblower Edward Snowden are among some prominent names who will be participating in the conference.

Ether ETFs are on the way

New Ether Spot ETFs are set to begin trading on Tuesday, July 23. Much like the spot Bitcoin ETFs, these ETFs will allow investors to buy the second most popular cryptocurrency like stocks. BlackRock, Ark Invest/21Shares, VanEck, Grayscale, Fidelity, Bitwise, Franklin Templeton, and Invesco/Galaxy Digital are all set to offer Ether ETFs. Crypto asset manager Bitwise predict that trading in the Ether ETF will drive the price of Ether higher, potentially surpassing $5,000.

Bitcoin

Cryptocurrency’s Biggest Winners and Losers in a Second Trump Presidency

Bitcoin miners and cryptocurrency companies that have been blocked from going public in the U.S. could ultimately be the biggest winners in the digital asset world under a second Donald Trump presidency. Foreign companies at risk of losing market share could end up being the biggest losers.

That’s the view that’s taking hold among market participants and observers in the wake of the former president’s growing embrace of cryptocurrency as his chances of election grow. survey released Thursday by CBS News showed Trump with the majority — 52 percent — of likely voters in his likely November rematch with President Joe Biden.

Bitcoin

Bitcoin, Ethereum, Solana and Cryptocurrency Markets Look Ready to ‘Send’ as Stars Align, According to Investor Chris Burniske

Cryptocurrency investor Chris Burniske says Bitcoin (BTC), Ethereum (ETH), Solana (SUN) and the cryptocurrency market in general seem poised for a run.

Former Head of Cryptocurrency at ARK Invest account his 292,200 followers on social media platform X that several catalysts are aligning, suggesting that digital asset markets are on the verge of a bull run.

According to Burniske, a partner at venture capital firm Placeholder, the highly anticipated launch of Ethereum-based exchange-traded funds (ETFs), Republican presidential candidate Donald Trump speaking at an upcoming Bitcoin event, and the current state of the BTC, ETH, and SOL charts all suggest significant optimism for the cryptocurrency markets.

“With ETH ETFs set to go live, Trump speaking at The Bitcoin Conference, and BTC, ETH, and SOL charts looking [they do] (while stocks are weak), it’s hard to imagine a world where we don’t ship next week.”

Reuters recently reported that preliminary approval for ETH ETFs has been granted as the Bitcoin Conference is scheduled to take place from July 25-27.

BTC, ETH, and SOL are trading at $67,333, $3,528, and $174 at the time of writing, respectively.

The venture capitalist too provides an update on his prediction that the total crypto market cap will eventually hit $10 trillion. According to his chart, the path to $10 trillion is currently “23%” complete, as it sits around $2.2 trillion.

Source: Chris BurniskeX

Earlier this month, Burniske he said in an interview with Real Vision CEO Raoul Paul that he has his eye on the Move ecosystem, which was originally built by social media giant Meta and then used to develop layer 1 blockchains Sui (IUE) and Apts (APT).

Don’t miss a beat – Subscribe to receive email alerts directly to your inbox

To check Price action

Follow us on X, Facebook It is Telegram

Surf Hodl’s Daily Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be aware that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: DALLE3

Bitcoin

Here’s the next target for BTC before bulls can hold out for $70K

Bitcoin’s recovery is going well, and the market is seemingly poised to create a new all-time high in the near term.

Technical analysis

Per NegotiationRage

The daily chart

As the daily chart shows, the price of Bitcoin has been rising since it broke above the 200-day moving average.

The market has also reclaimed the $60K and $65K levels and is moving towards the $68K resistance zone, which could be the last hurdle before creating a new all-time high. With the RSI also indicating that the price has clear bullish momentum, it could be just a matter of time.

The 4-hour chart

Looking at the 4-hour chart, it is evident that the price has been rising rapidly since breaking the downtrend line to the upside. The market also broke the $65K resistance level with momentum, turning it into a support.

While almost everything points to a new record high in the coming weeks, there is one worrying sign. The RSI is showing a clear bearish divergence between recent price highs, which could indicate a correction or even a reversal in the near term.

Source: TradingView SPECIAL OFFER (Sponsored)

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive an exclusive $600 welcome offer on Binance (Full details).

LIMITED OFFER 2024 on BYDFi Exchange: Welcome Reward Up to $2,888, use this link to register and open a 100 USDT-M position for free!

Disclaimer: The information found on CryptoPotato is that of the writers quoted. It does not represent the opinions of CryptoPotato about buying, selling, or holding any investments. It is advised that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

Cryptocurrency Charts by TradingView.

-

Nfts1 year ago

Nfts1 year agoShardLab Launches ZK-Based Tool for Digital Identity and NFT Vouchers

-

News1 year ago

News1 year agoWallet recovery firms are abuzz as stranded cryptocurrency investors panic in the bitcoin boom

-

Bitcoin1 year ago

Bitcoin1 year agoBitcoin, Ethereum, Solana and Cryptocurrency Markets Look Ready to ‘Send’ as Stars Align, According to Investor Chris Burniske

-

Altcoins1 year ago

Altcoins1 year agoThree Altcoins Poised for Significant Growth in 2024: ETFS, OP, BLAST

-

Altcoins1 year ago

Altcoins1 year agoAccumulate these altcoins now for maximum gains

-

Nfts1 year ago

Nfts1 year agoOG Crypto Artist Trevor Jones Unveils Groundbreaking Collection of Ordinals | NFT CULTURE | NFT News | Web3 Culture

-

Bitcoin1 year ago

Bitcoin1 year agoBillionaires are selling Nvidia stock and buying an index fund that could rise as much as 5,655%, according to some Wall Street analysts

-

Videos9 months ago

Videos9 months agoKamala just won the boner! [Bad For Crypto]

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!

-

News1 year ago

News1 year agoA Guide for Newcomers & Beginners – Forbes Advisor

-

Videos1 year ago

Videos1 year agoAttention: a historically significant BITCOIN signal has just appeared!

-

Videos1 year ago

Videos1 year agoSTOCK MARKET FUD! ⚠️ [Why This Is GREAT For Bitcoin Traders!]