Nfts

The aura of cryptocurrencies (and the death of NFTs)

Walter Benjamin does crypto

Group of men

An argument for crypto (via Walter Benjamin)

I got a brief glimpse of what those on the front lines of crypto experience on a daily basis when I created what I thought would be a fairly non-controversial post on LinkedIn on the speed (or lack thereof) with which cryptocurrencies have been adopted into mainstream commerce. The response to my post contained a wide range of different views, but it was notable that Bitcoin advocates were more vocal and sometimes downright aggressive in their tone, accusing me of either a deliberate attempt to sabotage their blockchain revolution , or blindness. incurred by being in the pocket of Big Fiat Currency for so long. This is a shame, because I tend to be one of the most enthusiastic voices when it comes to crypto discussions on the trading floor.

It seems symptomatic of our times that positions on cryptocurrencies have become so quickly entrenched – you are either violently pro or decidedly anti – that there is very little room left for a nuanced discussion about the pros and cons of this revolution for the world of money. HAS Group of men, we approached crypto like we approach any new asset class, undertaking enormous research, carrying out in-depth studies into the potential risks and how to mitigate them. We then moved to live trading and have now integrated Bitcoin and Ether into a number of our systematic strategies.

One of the crypto champions within the company is Tarek Abou Zeidpartner and senior client portfolio manager at Male AHL. Tarek spoke eloquently about Bitcoin and Ether at our Unconventional Investing Conference at the Whitney Gallery last week. He made a comparison between NFTs – much laughing at the sums paid for Bored Apes and real estate in virtual worlds – and crypto.

A bored monkey

Bored monkey

Tarek’s argument centered on the relative price action exhibited by these speculative assets and that of cryptocurrencies. It showed that NFTs followed similar price trajectories to a number of historical bubbles, from tulips to railways to South Sea stocks. They spiral up as excitement builds, then, when the bubble bursts, they crash spectacularly.

Crash of a bored monkey

NFT floor price

Bitcoin, Ether and the other most liquid cryptocurrencies, however, behaved quite differently. In Tarek’s words: “A bubble is a persistent deviation from fundamental value… there is a distinguishing feature between coin price behavior and classic historical bubbles: crypto declines have been (until present) always followed by repeats. »

Bitcoin Price Recoveries

CoinDesk

Their price action more closely tracks all other developing asset classes in their early stages – from emerging market stocks to high yield debt or, looking further afield, the volatility exhibited by gold prices as it became accepted as a financial asset around the world. first years of the last century. The difference with these assets is that, despite the significant declines they suffered as investors went through cycles of greed and fear, acceptance and rejection, they always experienced a recovery. It’s a thesis that gives significant weight to the notion of crypto as a nascent asset class going through the early stages of a path to maturity.

After his talk, I directed Tarek to a 1935 essay by the great Walter Benjamin: “The Work of Art in the Age of Mechanical Reproduction.” In the essay, Benjamin talks about how the arrival of mechanical printing changed the way people thought about works of art. Benjamin writes about the “aura” of the original painting – the Mona Lisa, for example – which is linked to its place in time and space, to its incontestable authenticity. Rather than diminishing the aura, he continues, mass printing of artworks only accentuated the power of the original’s unique status.

This seems like a useful model for thinking about the divide between NFTs and cryptocurrencies, which I believe are both attempting to use blockchain technology to establish a source of value. Benjamin says: “what withers in the age of mechanical reproduction is the aura of the work of art.” The Mona Lisa on the wall of a university residence hall is devoid of all but the slightest fragment of the power of the work on display at the Louvre. The original retains all the power. NFTs have simply failed to overcome this fundamental observation. Their problem was that they were trying to create a virtual aura in a world of near-perfect replicability. No one could tell just by looking if your Bored Ape is different from the copy I just captured on my laptop.

I would argue that cryptocurrencies have achieved something different by removing any physical manifestation of their unique status and focusing entirely on the concept of scarcity and its connection to value. Unlike NFTs, which attempt to give digital assets an aura through their provenance but fail because they remain easily reproducible, cryptocurrencies derive their digital aura from the abstraction of their creation: complex mathematical processes and decentralized verification mechanisms. This abstraction not only ensures that each individual cryptocurrency retains its share of authenticity, uniqueness and rarity, but also gives the entire crypto world an air of ritual and quasi-religiosity, which Benjamin declared that mechanical reproduction had taken away from the art world. .

Cryptocurrencies as an asset class are of particular interest to our systematic strategies: they are increasingly liquid, move in recognizable patterns that work well within a trend framework, and are increasingly the subject of an institutional interest. They also offer real diversification, with little correlation with other assets.

Crypto in Trending Strategies

Bloomberg

Benjamin’s essay, linked here, is a fine example of how truly first-rate thinking can be adapted and applied to new worlds unimaginable to their authors. So the next time you check your crypto portfolio, think about one of the great minds of the 20th century and the aura that seems alive and well in digital currencies.

Nfts

NFTs Maintain Upward Momentum, Sales Volume Surpasses $107 Million

Non-fungible tokens, or NFTs, saw sales volume surge for the second week in a row, reaching $107 million, an increase of 8.5%.

A substantial increase in the number of NFT Buyers accompanied this growth, reaching 488,141 — a staggering increase of 89.56%.

On the other hand, the number of NFT sellers also increased by 69.8%, totaling 198,450, signaling an improved business environment and increased market engagement.

Below is a look at what happened in the NFT market over the past week.

Ethereum Maintains Leading Position While Solana and Bitcoin Follow

Blockchains by weekly NFT sales volume | Source: CryptoSlam

Over the past few weeks, Ethereum (ETH) continued to dominate the NFT market with $36.6 million in total sales, driven by 35,236 buyers, a 46.31% increase from the previous week.

Solana (GROUND) has emerged as a serious competitor, recording total revenue of $26.15 million, thanks to a substantial 114.07% increase in the number of buyers.

Bitcoin (Bitcoin) The NFT market also saw a notable surge, with total sales reaching $21.4 million, thanks to a staggering 222.29% increase in buyers.

Polygon (MATICS), which had the second best performance the previous week, saw its total sales volume drop by more than 15%, dropping it to 4th place just ahead of Immutable (IMX).

Other notable performances were achieved by Zora and Blast, which recorded the two largest percentage increases in sales volume, at 463% and 227% respectively.

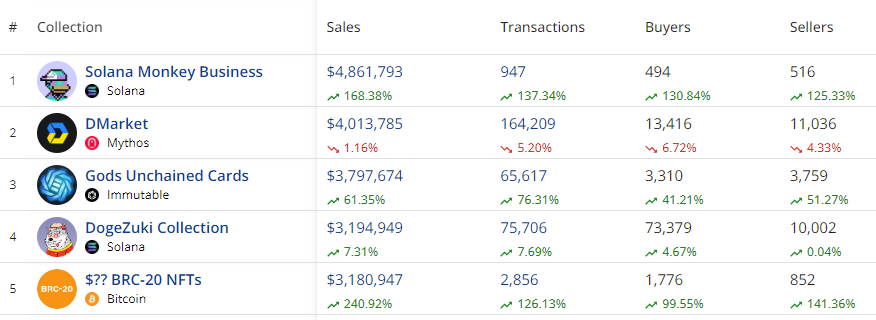

Best Collections: Solana Monkey Business Shines

Ranking NFT collections by weekly sales volume | Source: CryptoSlam

Ranking NFT collections by weekly sales volume | Source: CryptoSlam

Among the top NFT collections, Solana Monkey Business came out on top with $4.86 million in sales, an increase of 168.38%. The collection also saw a significant increase in transactions (137.34%) and buyers (130.84%).

The DMarket collection on the Mythos blockchain, which recorded $4.01 million in sales, came in a close second. Interestingly, this is the only collection among the top 5 by sales volume to see a decline in the number of transactions and buyers.

Immutable’s Gods Unchained cards also made headlines with $3.8 million in sales, an increase of 61.35%. This collection saw notable growth in both transactions (76.31%) and buyers (41.21%), a testament to the growing popularity of blockchain-based trading cards.

Best-Selling NFTs and Fan Tokens

In terms of individual sales, Ethereum’s Autoglyphs #167 led with a sale of $274,561, followed by Bitcoin’s Protoshrooms with $148,574. Other notable sales included BNB’s kNFT: Locked kUSDT and Arbitrum’s Umoja Synths, highlighting the diversity and breadth of the NFT market across different blockchains.

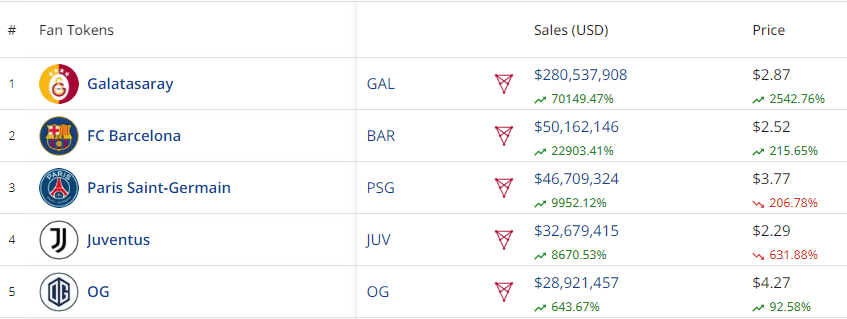

Top 5 Fan Tokens by Sales Volume

Top 5 Fan Tokens by Sales Volume

As can be seen in the table above CryptoSlamFan tokens also continued to see explosive growth, with Galatasaray’s token on the Chiliz blockchain recording a turnover of $280.5 million. This reflects an increase of 70149.47%.

FC Barcelona and Paris Saint-Germain followed with substantial sales volumes, indicating the growing popularity of sports-related NFTs.

Market consequences

The latest performance of the NFT market marks a significant turnaround, demonstrating resilience and renewed investor interest after a period of declining sales volumes.

This is the second consecutive week of improved sales, suggesting a potential upward trend. It is worth noting that this resurgence comes amid a broader recovery in the cryptocurrency market, which is currently valued at $2.55 trillion.

Major cryptocurrencies like Bitcoin, Ethereum, BNB, and Solana have all registered Prices have risen by double digits over the past week, further fueling optimism in the digital asset sector.

The correlation between rising cryptocurrency prices and the recovery of the NFT market could be an indication of strengthening investor confidence, setting a positive tone for the coming weeks.

Nfts

APENFT’s One-Day Trading Volume Hits $16.67 Million (NFT)

APENFT (NFT) fell 0.3% against the U.S. dollar in the 24-hour period ending at 9:00 a.m. ET on July 21. APENFT has a market cap of $8.54 million and $16.67 million worth of APENFT was traded on exchanges over the past day. Over the past week, APENFT has been trading 3.1% lower against the US Dollar. One APENFT token can now be purchased for around $0.0000 or 0.00000000 BTC on major cryptocurrency exchanges.

Here’s how other cryptocurrencies performed over the past day:

- KILT Protocol (KILT) is up 1.9% against the dollar and is now trading at $0.20 or 0.00000302 BTC.

- Aidi Finance (BSC) (AIDI) fell 2.2% against the dollar and is now trading at $0.0000 or 0.00000000 BTC.

- Zoo Token (ZOOT) fell 2.2% against the dollar and is now trading at $0.0652 or 0.00000239 BTC.

- CareCoin (CARES) fell 2.2% against the dollar and is now trading at $0.0809 or 0.00000297 BTC.

- Kitty Inu (KITTY) rose 1.9% against the dollar and is now trading at $95.84 or 0.00338062 BTC.

- Hokkaidu Inu (HOKK) rose 1.2% against the dollar and is now trading at $0.0004 or 0.00000001 BTC.

- Jeff in Space (JEFF) fell 2.2% against the dollar and is now trading at $2.75 or 0.00010076 BTC.

- Lumi Credits (LUMI) fell 0.7% against the dollar and is now trading at $0.0128 or 0.00000019 BTC.

- AXIA Coin (AXC) fell 0.1% against the dollar and is now trading at $13.43 or 0.00048094 BTC.

About APENFT

APENFT launched on March 28, 2021. The total supply of APENFT is 999,990,000,000,000 tokens and its circulating supply is 19,999,800,000,000 tokens. The official website of APENFT is apenft.orgThe official APENFT Twitter account is @apenftorg and his Facebook page is accessible here.

According to CryptoCompare, “APENFT is a blockchain-based platform created by the APENFT Foundation to create, buy, sell, and trade non-fungible tokens (NFTs) on the TRON and Ethereum networks. It allows for the ownership and trading of unique digital assets such as artwork, music, videos, and more. It also provides tools for artists and creators to create and promote their own NFTs, as well as participate in community events and governance.”

APENFT Token Trading

It is not currently generally possible to purchase alternative cryptocurrencies such as APENFT directly using US dollars. Investors wishing to acquire APENFT must first purchase Ethereum or Bitcoin using an exchange that deals in US dollars such as CoinbaseGDAX or Gemini. Investors can then use their newly acquired Ethereum or Bitcoin to purchase APENFT using any of the exchanges listed above.

Receive daily news and updates from APENFT – Enter your email address below to receive a concise daily summary of the latest news and updates for APENFT and associated cryptocurrencies with FREE CryptoBeat Newsletter from MarketBeat.com.

Nfts

Next US Vice President JD Vance Holds Bitcoin and NFTs, Expected to Boost MATIC and Algotech Post-Election

The blockchain technology landscape is about to transform as JD Vance, the likely next US vice president, emerges as a strong advocate for digital assets. Recent reports suggest that Vance not only holds Bitcoin (BTC) and NFTs, but is also willing to back promising blockchain initiatives like Polygon (MATIC) and Algotech (ALGT) post-elections.

JD Vance’s Cryptocurrency Investments Highlight Shift in Government Perspective

U.S. Senator JD Vance has garnered considerable attention for his recent investments in Bitcoin (BTC) and NFTs. Public records indicate that he owns between $100,000 and $250,000 worth of Bitcoin (BTC), indicating considerable interest in the success of the cryptocurrency market. This level of financial commitment from a high-profile government figure is unprecedented and underscores the growing credibility and promise of digital assets.

JD Vance’s interests extend beyond Bitcoin (BTC) to non-fungible tokens (NFTs), with reports suggesting his involvement in acquiring notable pieces from renowned collections. While the details of his NFT portfolio remain unknown, those who know the senator confirm his foray into this field.

This exploration of NFTs underscores Vance’s openness to exploring innovative and artistic applications of blockchain technology beyond cryptocurrencies’ typical role as assets or means of exchange. Vance’s involvement with cryptocurrency stands in stark contrast to the views of many of his peers in Congress, who often express doubt or hostility toward digital currency.

His direct involvement as an investor and user of these technologies gives him a unique perspective on their potential benefits and drawbacks. This practical understanding is likely to influence his stance on policy and regulation should he take on the role of vice president.

Polygon (MATIC) Hits $0.53, Eyes Breakout Amid Market Slowdown

The Vance administration, known for its support for cryptocurrencies, could significantly boost Polygon (MATIC), a major Ethereum layer 2 scaling project. MATIC has already attracted the attention of the developer community for its innovative solutions.

Even so, regulatory uncertainties have slowed widespread adoption and integration with traditional financial systems. Vance’s backing could serve as a driving force to unlock Polygon’s untapped capabilities.

A recent look at the MATIC token shows that its current trading value is $0.53, which represents an increase of over 2% in the last 24 hours. This surge coincides with a downturn in the broader cryptocurrency market, signaling solid fundamental strength and a growing sense of confidence among investors regarding Polygon’s future prospects.

Based on technical indicators, MATIC appears to be facing a resistance level that has persisted for several months, hinting at a potential breakout that could propel prices towards the previous peak around $1.29.

MATIC’s cutting-edge technology has taken a significant leap forward with the introduction of the Plonky3 zero-knowledge proof system. This innovation in zk-rollup technology is set to revolutionize MATIC’s scalability and efficiency, cementing its position as the premier choice for developers and enterprises.

Algotech (ALGT) Eyes $1 Price Hike When Its Exchange Launches

Algotech, a project that has attracted the interest of crypto enthusiasts and JD Vance, aims to transform algorithmic trading in the cryptocurrency space. Through the use of artificial intelligence and machine learning, Algotech offers advanced trading strategies to ordinary investors.

The platform’s innovative approach and ambitious roadmap are in line with JD Vance’s goal of driving financial innovation and making sophisticated investment tools more accessible to all. Algotech’s decentralized structure stands out, aligning perfectly with the core principles of blockchain technology.

By cutting out the middleman and giving users direct authority over their trading algorithms, Algotech embodies the essence of financial independence advocated by many in the crypto community, including Vance. This common ground makes Algotech a natural choice for endorsement by crypto-friendly leadership.

As Algotech’s pre-sale gains momentum, with over $9.6 million in funding, excitement is building for its official launch. Analysts have set lofty price targets, with some even suggesting that ALGT could surge to $1 shortly after it goes public.

While it’s wise to approach these predictions with caution, the combination of Algotech’s cutting-edge technology and the potential backing of key figures like JD Vance could pave the way for significant growth and adoption.

Learn more:

Disclaimer: This is a paid release. The statements, views, and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of Bitcoinist. Bitcoinist does not guarantee the accuracy or timeliness of any information available in this content. Do your research and invest at your own risk.

Nfts

OG Crypto Artist Trevor Jones Unveils Groundbreaking Collection of Ordinals | NFT CULTURE | NFT News | Web3 Culture

Trevor Jones’ New Genesis BTC Collection: CryptoAngels

Known for his innovative blend of physical and digital art, Trevor Jones continues to push the boundaries of the NFT space with his latest collection, CryptoAngels. Since his foray into Bitcoin-themed artwork in 2017, Jones has garnered a significant following, cementing his reputation with record-breaking sales and community events.

The Bitcoin Angel Journey

In 2021, Jones made headlines with his Bitcoin Angel open edition, selling 4,158 editions for an incredible $3.2 million in just seven minutes. This success paved the way for his latest venture, where he combines art, community, and technology in new ways. His annual Castle Parties, celebrating art, culture, and charity, have further cemented his place in the Web3 world.

CryptoAngels Collection Review

Jones’ CryptoAngels collection is divided into two main stages: Archangels and CryptoAngels.

- Step 1: The Archangels The initial phase, Archangels, saw 21 collector’s packages sold for 87.9 ETH (approximately $335,291). Each package included:

- A physical bronze sculpture of the Bitcoin angel

- A 3D NFT avatar

- An Archangel Ordinal

Esteemed collectors like ModeratsArt, Batsoupyum, Bharat Krymo, Blondie23LMD, and 1Confirmation now lead the CryptoAngel army as Archangel Collectors.

- Step 2: CryptoAngels The second phase, set to launch on August 7, features 7,777 unique CryptoAngels. These will be available for minting via OrdinalsBot, starting with a whitelisting phase. Each CryptoAngel is distinct and named by Jones himself. The collection is organized into 21 cohorts, each associated with one of Archangel’s collectors, fostering sub-communities within the larger collection. Additionally, there are seven 1/1 CryptoAngels, making them exceptionally rare and not aligned with a cohort.

Connecting Bitcoin and Art

Jones, who has been a strong Bitcoin supporter since mid-2017, expresses his deep connection to the crypto community. He sees the CryptoAngels collection as a tribute to that community, bringing his iconic Bitcoin Angel motif to the blockchain.

“I have been personally investing in Bitcoin since mid-2017 and its ethos quickly inspired me in my crypto art journey. I have followed the growth of Ordinals since its inception and the CryptoAngels collection is my offering to a community that has welcomed me with open arms and given me the opportunity to bring my Bitcoin Angel motif to the chain where it was always meant to be,” said artist Trevor Jones.

Collectors’ opinions

“Bitcoin’s OG artist Trevor Jones, behind the Bitcoin Angels depositing ordinals on the immutable chain is a match made in crypto-native art heaven.” – Bharat Krymo (@krybharat – Archangel Collector)

“The 2018 Bitcoin Angel oil painting is one of the first crypto tributes to Bitcoin, so CryptoAngels on Ordinals is a natural extension of Trevor’s artistic journey” – batsoupyum (Archangel Collector)

Interactive experience and limited editions

Rounding out the collection, 21 special Angels will be available to mint for $7 each on Base, playable in the exclusive retro arcade game, Dante’s Pixel Inferno. The game challenges players to guide their Angel through the nine circles of Fiat Hell, collecting Bitcoin and earning rewards. Each Angel in the game has unique abilities and weapons.

Whitelisting Opportunities and Community Engagement

Whitelisting (WL) opportunities are available through community partnerships, existing Bitcoin Angel OE and Trevor’s Ascended Angels holders, and weekly giveaways. To stay up to date and secure a spot on the whitelist, join Trevor Jones’ active Discord community.

TL;DR

Trevor Jones is launching the CryptoAngels collection on August 7th, building on his Bitcoin Angel legacy. Split into two stages, Archangels and CryptoAngels, the collection includes unique NFTs and physical artworks, fostering strong community connections. Exclusive gaming experiences and limited minting opportunities enhance engagement. Join the Discord for your chance to win.

-

Nfts1 year ago

Nfts1 year agoShardLab Launches ZK-Based Tool for Digital Identity and NFT Vouchers

-

News1 year ago

News1 year agoWallet recovery firms are abuzz as stranded cryptocurrency investors panic in the bitcoin boom

-

Bitcoin1 year ago

Bitcoin1 year agoBitcoin, Ethereum, Solana and Cryptocurrency Markets Look Ready to ‘Send’ as Stars Align, According to Investor Chris Burniske

-

Altcoins12 months ago

Altcoins12 months agoThree Altcoins Poised for Significant Growth in 2024: ETFS, OP, BLAST

-

Altcoins12 months ago

Altcoins12 months agoAccumulate these altcoins now for maximum gains

-

Nfts1 year ago

Nfts1 year agoOG Crypto Artist Trevor Jones Unveils Groundbreaking Collection of Ordinals | NFT CULTURE | NFT News | Web3 Culture

-

Bitcoin1 year ago

Bitcoin1 year agoBillionaires are selling Nvidia stock and buying an index fund that could rise as much as 5,655%, according to some Wall Street analysts

-

Videos9 months ago

Videos9 months agoKamala just won the boner! [Bad For Crypto]

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!

-

News1 year ago

News1 year agoA Guide for Newcomers & Beginners – Forbes Advisor

-

Videos1 year ago

Videos1 year agoAttention: a historically significant BITCOIN signal has just appeared!

-

Videos1 year ago

Videos1 year agoSTOCK MARKET FUD! ⚠️ [Why This Is GREAT For Bitcoin Traders!]