Bitcoin

Bitcoin Rally and ‘Short Memories’ Rekindle Everything in Crypto

(Bloomberg) — Bitcoin’s rally to near a record high is stirring up animal spirits — not just in the cryptocurrency market itself, but in the broader financial world that left the digital asset sector for dead last year.

Bloomberg’s Most Read

The shift in sentiment can be seen in the improving outlook for deal flow, highlighted by Robinhood Markets Inc.’s purchase of crypto exchange Bitstamp Ltd. on Thursday, to a resurgence of venture capital investment to what some Analysts expect a record number of initial public offerings from companies linked to the sector.

In the crypto market itself, there has been a notable return of the characteristics of previous bull markets: celebrities are once again promoting crypto and new tokens are being created at a rate of thousands per day, with around 330,000 coins debuting in the Ethereum ecosystem in April and May only, according to crypto data tracker Dune.

Taken together, it demonstrates that there is nothing like rising prices to make investors forget the financial carnage of the past – including bankruptcies of cryptocurrency exchange FTX and lender Celsius – in a market that is more famous for its scandals and boom cycles. and fall.

“Investors often have short memories,” said Campbell Harvey, a finance professor at Duke University. “When market sentiment is high, they give extra weight to good news and tend to downplay bad news that may have happened in the past.”

Bitcoin rose this week to within 2.5% of the all-time high of $73,798 reached in mid-March amid growing demand for newly authorized exchange-traded funds. Although the leading digital currency has risen nearly 70% already this year, the gains pale in comparison to the returns of extremely speculative memecoins like Dogwifhat and Bonk.

This year’s boom accelerated when the Securities and Exchange Commission approved ETFs investing directly in Bitcoin in January. Then, in May, the agency took a step toward approving similar spot Ether ETFs, a move that many in the industry saw as giving in to increasing political pressure to legitimize crypto and create new laws that would make it easier for exchange companies to operate. digital assets.

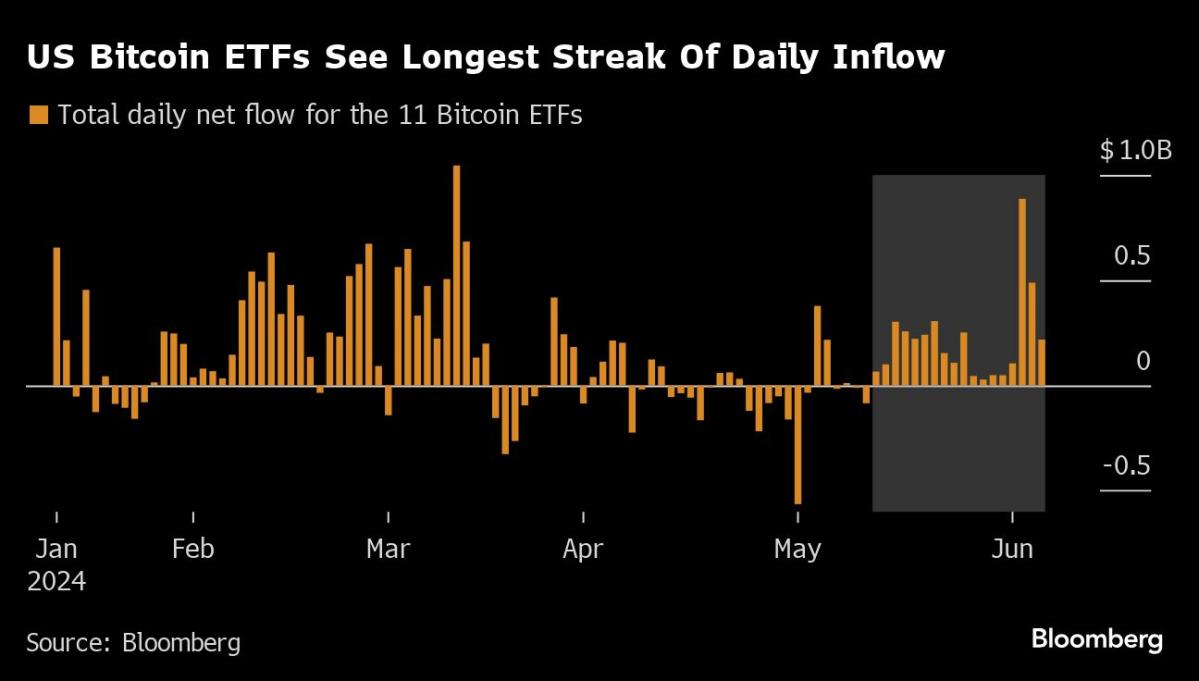

US Bitcoin ETFs attracted inflows for an unprecedented 18th consecutive day through Thursday. Net subscriptions for the group of nearly a dozen products stood at $15.6 billion, bringing total assets to $62.3 billion, according to data compiled by Bloomberg.

The story continues

Large financial companies are delving deeper into crypto. Earlier this week, Mastercard once again allowed users of the world’s largest cryptocurrency exchange, Binance, to make purchases on its network. Binance settled with the Department of Justice over anti-money laundering and other violations last year and is still fighting SEC charges.

“Over the past few months, we have reviewed the enhanced controls and processes that Binance has implemented,” a Mastercard spokesperson said in a statement. “It is based on these efforts that we have decided to allow Binance-related purchases on our network. This status depends on ongoing reviews.”

Crypto MNA is also heating up. This week, Bitcoin miner Core Scientific Inc. rejected an unsolicited $1 billion takeover offer from artificial intelligence startup CoreWeave Inc., just days after announcing a partnership. On Thursday, Robinhood said it will acquire Bitstamp for $200 million to expand its crypto business in Europe.

“A U.S. regulatory framework creates an environment of speed of innovation that accelerates institution-building purchasing decisions and drives a robust M&A environment,” said Elliot Chun, partner at consultancy MNA Architect Partners, in a note. recent. “I will be bold and say that in May 2024, our industry has officially transitioned from #TheGreatPurge and entered #TheGreatSurge.”

Crypto funds are booming, with more funds launched in the first quarter than at any time since the second quarter of 2021, according to Crypto Fund Research.

Talk of new crypto IPOs is reviving, with Kraken said to be in talks for a pre-IPO funding round, while planning an IPO as early as 2025, Bloomberg reported on Thursday. If cryptocurrency prices continue to rise, the next 18 months could see the largest wave of cryptocurrency-related IPOs on record, according to Renaissance Capital, a pre-IPO researcher.

“I think if these companies can point to explosive revenue growth or strong profits, that will attract investor interest,” said Matthew Kennedy, senior market researcher at Renaissance. “I suspect the financials are there and investors will take them with a grain of salt – they know it’s a cyclical business, a lot of companies are like that.”

Bloomberg Businessweek Most Read

©2024 Bloomberg LP

Bitcoin

What to watch for in the markets

Photo: Andrew Harnik (Getty Images)

After witnessing one of the largest global IT outages on record, affecting the travel, finance and healthcare sectors worldwideThis week is set to see more political drama, events, and earnings reports from tech giants.

Donald Trump’s ‘Lovefest’ Sets Jamie Dimon Up for Consideration for Treasury Secretary Job

Let’s take a look at what awaits us:

Major companies will release their earnings reports

Major tech companies and others will release their earnings reports this week, paving the way for what the second half of 2024 will look like.

Monday

- Verizon will report earnings before the start of operations.

Tuesday

- Coca-Cola, Comcast and UPS are all set to report earnings before the market opens.

- Tesla will report earnings in the morning, while General Motors will report earnings in the evening.

- Alphabet and Visa will report results after the market closes.

Wednesday

- AT&T will release its report before the market opens.

- Ford and Chipotle will report earnings after the market closes.

Thursday

- Earnings reports from AstraZeneca, American Airlines and Southwest Airlines will be released before the market opens.

Trump to speak at Bitcoin conference

Presumptive Republican presidential nominee Donald Trump will speak at the next Bitcoin Conference in Nashville, Tennesseewhich is scheduled for July 25-27. While this is the first time a presidential candidate will attend the conference, it has sparked a debate over whether the crypto-friendly Trump will receive support from the crypto community in the upcoming election.

In addition to Trump, independent presidential candidate Robert F. Kennedy Jr. will also discuss crypto during the conference. Crypto advocates such as ARK Investment’s Cathie Wood, MicroStrategy’s Michael Saylor, and whistleblower Edward Snowden are among some prominent names who will be participating in the conference.

Ether ETFs are on the way

New Ether Spot ETFs are set to begin trading on Tuesday, July 23. Much like the spot Bitcoin ETFs, these ETFs will allow investors to buy the second most popular cryptocurrency like stocks. BlackRock, Ark Invest/21Shares, VanEck, Grayscale, Fidelity, Bitwise, Franklin Templeton, and Invesco/Galaxy Digital are all set to offer Ether ETFs. Crypto asset manager Bitwise predict that trading in the Ether ETF will drive the price of Ether higher, potentially surpassing $5,000.

Bitcoin

Cryptocurrency’s Biggest Winners and Losers in a Second Trump Presidency

Bitcoin miners and cryptocurrency companies that have been blocked from going public in the U.S. could ultimately be the biggest winners in the digital asset world under a second Donald Trump presidency. Foreign companies at risk of losing market share could end up being the biggest losers.

That’s the view that’s taking hold among market participants and observers in the wake of the former president’s growing embrace of cryptocurrency as his chances of election grow. survey released Thursday by CBS News showed Trump with the majority — 52 percent — of likely voters in his likely November rematch with President Joe Biden.

Bitcoin

Bitcoin, Ethereum, Solana and Cryptocurrency Markets Look Ready to ‘Send’ as Stars Align, According to Investor Chris Burniske

Cryptocurrency investor Chris Burniske says Bitcoin (BTC), Ethereum (ETH), Solana (SUN) and the cryptocurrency market in general seem poised for a run.

Former Head of Cryptocurrency at ARK Invest account his 292,200 followers on social media platform X that several catalysts are aligning, suggesting that digital asset markets are on the verge of a bull run.

According to Burniske, a partner at venture capital firm Placeholder, the highly anticipated launch of Ethereum-based exchange-traded funds (ETFs), Republican presidential candidate Donald Trump speaking at an upcoming Bitcoin event, and the current state of the BTC, ETH, and SOL charts all suggest significant optimism for the cryptocurrency markets.

“With ETH ETFs set to go live, Trump speaking at The Bitcoin Conference, and BTC, ETH, and SOL charts looking [they do] (while stocks are weak), it’s hard to imagine a world where we don’t ship next week.”

Reuters recently reported that preliminary approval for ETH ETFs has been granted as the Bitcoin Conference is scheduled to take place from July 25-27.

BTC, ETH, and SOL are trading at $67,333, $3,528, and $174 at the time of writing, respectively.

The venture capitalist too provides an update on his prediction that the total crypto market cap will eventually hit $10 trillion. According to his chart, the path to $10 trillion is currently “23%” complete, as it sits around $2.2 trillion.

Source: Chris BurniskeX

Earlier this month, Burniske he said in an interview with Real Vision CEO Raoul Paul that he has his eye on the Move ecosystem, which was originally built by social media giant Meta and then used to develop layer 1 blockchains Sui (IUE) and Apts (APT).

Don’t miss a beat – Subscribe to receive email alerts directly to your inbox

To check Price action

Follow us on X, Facebook It is Telegram

Surf Hodl’s Daily Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be aware that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: DALLE3

Bitcoin

Here’s the next target for BTC before bulls can hold out for $70K

Bitcoin’s recovery is going well, and the market is seemingly poised to create a new all-time high in the near term.

Technical analysis

Per NegotiationRage

The daily chart

As the daily chart shows, the price of Bitcoin has been rising since it broke above the 200-day moving average.

The market has also reclaimed the $60K and $65K levels and is moving towards the $68K resistance zone, which could be the last hurdle before creating a new all-time high. With the RSI also indicating that the price has clear bullish momentum, it could be just a matter of time.

The 4-hour chart

Looking at the 4-hour chart, it is evident that the price has been rising rapidly since breaking the downtrend line to the upside. The market also broke the $65K resistance level with momentum, turning it into a support.

While almost everything points to a new record high in the coming weeks, there is one worrying sign. The RSI is showing a clear bearish divergence between recent price highs, which could indicate a correction or even a reversal in the near term.

Source: TradingView SPECIAL OFFER (Sponsored)

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive an exclusive $600 welcome offer on Binance (Full details).

LIMITED OFFER 2024 on BYDFi Exchange: Welcome Reward Up to $2,888, use this link to register and open a 100 USDT-M position for free!

Disclaimer: The information found on CryptoPotato is that of the writers quoted. It does not represent the opinions of CryptoPotato about buying, selling, or holding any investments. It is advised that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

Cryptocurrency Charts by TradingView.

-

Nfts1 year ago

Nfts1 year agoShardLab Launches ZK-Based Tool for Digital Identity and NFT Vouchers

-

News1 year ago

News1 year agoWallet recovery firms are abuzz as stranded cryptocurrency investors panic in the bitcoin boom

-

Bitcoin1 year ago

Bitcoin1 year agoBitcoin, Ethereum, Solana and Cryptocurrency Markets Look Ready to ‘Send’ as Stars Align, According to Investor Chris Burniske

-

Altcoins1 year ago

Altcoins1 year agoThree Altcoins Poised for Significant Growth in 2024: ETFS, OP, BLAST

-

Altcoins1 year ago

Altcoins1 year agoAccumulate these altcoins now for maximum gains

-

Nfts1 year ago

Nfts1 year agoOG Crypto Artist Trevor Jones Unveils Groundbreaking Collection of Ordinals | NFT CULTURE | NFT News | Web3 Culture

-

Bitcoin1 year ago

Bitcoin1 year agoBillionaires are selling Nvidia stock and buying an index fund that could rise as much as 5,655%, according to some Wall Street analysts

-

Videos9 months ago

Videos9 months agoKamala just won the boner! [Bad For Crypto]

-

Videos1 year ago

Videos1 year agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!

-

News1 year ago

News1 year agoA Guide for Newcomers & Beginners – Forbes Advisor

-

Videos1 year ago

Videos1 year agoAttention: a historically significant BITCOIN signal has just appeared!

-

Videos1 year ago

Videos1 year agoSTOCK MARKET FUD! ⚠️ [Why This Is GREAT For Bitcoin Traders!]